Broad-Based Emergency Liquidity

United States: Y2K Standby Financing Facility

Purpose

To “provide tangible encouragement to primary dealers to continue to make markets and to undertake their normal intermediation activities in securities markets, so as to sustain the liquidity of these markets around the century date change” (FRBNY 2000, 29).

Key Terms

-

Launch DatesAugust 24, 1999 (Announcement); October 20, 1999 (Operational)

-

Expiration DateDecember 1, 2000

-

Legal AuthoritySection 14 of the Federal Reserve Act

-

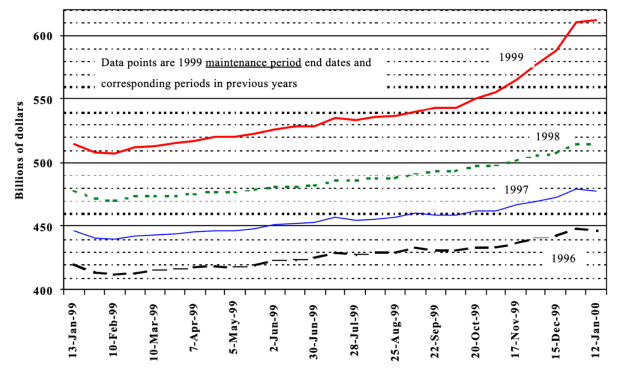

Peak Outstanding$481 billion in option purchased, none exercised

-

ParticipantsPrimary dealers

-

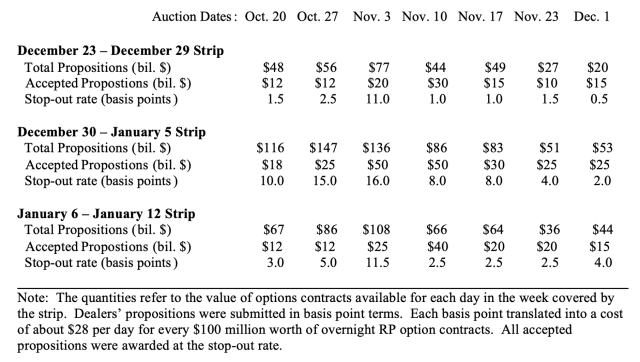

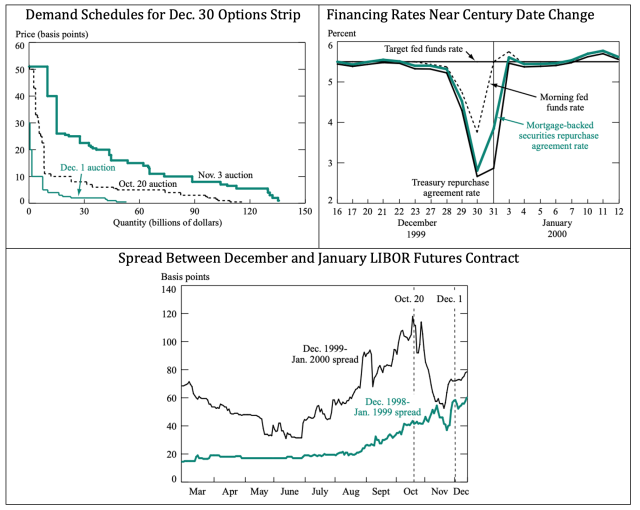

RateDutch-style auction, strike price 150bps over Federal Funds Rate (FFR)

-

CollateralDiscount-window collateral

-

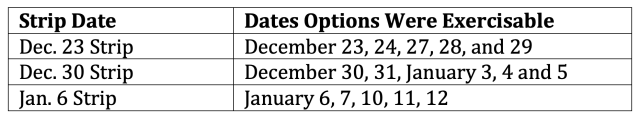

Loan DurationOvernight, on exercise date

-

Notable FeaturesUnique auction/option design

-

OutcomesNo options exercised; market calmed

Key Design Decisions

Purpose

Part of a Package

Management

Administration

Funding Source

Program Size

Individual Participation Limits

Rate Charged

Eligible Collateral or Assets

Loan Duration

Other Conditions

Impact on Monetary Policy Transmission

Other Options

Similar Programs in Other Countries

Communication

Disclosure

Stigma Strategy

Exit Strategy

Key Program Documents

Taxonomy

Intervention Categories:

- Broad-Based Emergency Liquidity

Countries and Regions:

- United States

Crises:

- Y2K (1999-2000)