Broad-Based Emergency Liquidity

United States: Term Auction Facility

Purpose

“to provide liquidity that would help normalize money markets, particularly term money markets, and would allow banks to make use of the enormous amount of collateral they have at the discount window, but would avoid the stigma” (FOMC and Fed 2007b)

Key Terms

-

Launch DatesAnnouncement: December 12, 2007; First settlement: December 20, 2007

-

Expiration DateLast settlement: March 11, 2010; Last maturity: April 8, 2010

-

Legal AuthorityFRA §10(B)

-

Peak OutstandingUSD 493 billion in March 2009

-

ParticipantsUS banks and US branches of foreign banks eligible for primary credit

-

RateSingle-price auction

-

CollateralDiscount-window eligible/overcollateralization

-

Loan Duration28-day or 84-day

-

Notable FeaturesProgram designed to combat discount-window stigma

-

OutcomesAll loans repaid

Following the announcement on August 9, 2007, by BNP Paribas that it was suspending redemptions for three of its open-end investment funds that had invested heavily in mortgage-backed securities, liquidity in the American interbank and short-term funding markets tightened considerably. On August 17, the Federal Reserve lowered the cost of borrowing from the discount window. However, usage remained low, due largely to the perception that such borrowing implied weak financials. In December, the Fed launched the Term Auction Facility (TAF), which used single-rate auctions to mitigate this stigma. The TAF offered discount-window credit of 28 days, and later, 84 days. Although the TAF avoided the stigma of the discount window, it relied heavily on the discount window’s infrastructure, and the same banks were eligible for both programs. Foreign banks could access TAF funds via their US branches or subsidiaries and ultimately accounted for about two-thirds of the program’s usage. The TAF provided USD 493 billion at its peak in March 2009 and was one of the Fed’s most-used programs during the Global Financial Crisis of 2007-09. A rich body of literature mostly concludes that the TAF reduced interbank funding stress.

On August 9, 2007, BNP Paribas, France’s largest bank, suspended redemptions on three investment funds because it was temporarily unable to value the private-label mortgage-backed securities that they held (BNP Paribas 2007). Many other banks and asset managers sustained losses in private-label mortgage-backed securities, and spreads between secured and unsecured overnight funding spiked, stressing America’s interbank funding market (Taylor and Williams 2009). Around the world, central banks provided large amounts of liquidity to quell the crisis (Borio and Nelson 2008). In the US, the Federal Reserve Board lowered the rate for primary creditFThe discount window offered banks three different types of credit—primary, secondary, and seasonal—depending on their financial soundness. Primary credit was available to generally sound institutions and carried a rate of 100 basis points (bps) above the Federal Open Market Committee’s target rate for federal funds prior to the Global Financial Crisis. Secondary credit, which required a greater degree of administration and carried a rate 50bps higher than primary credit, was available to banks considered too risky for primary credit. Seasonal credit offered credit to banks with seasonal variation in liquidity, such as those with clients concentrated in agriculture or tourism (Armantier, Krieger, and McAndrews 2008; Gilbert et al. 2012). at the discount window—its main lending channel—from 6.25% to 5.75% on August 17 (Fed 2007). In doing so, the Fed reduced the spread between its primary credit rate and the targeted federal funds rate from 100 to 50 basis points, effectively halving the interest rate penalty for discount-window borrowing (FOMC and Fed 2007a). On August 16, the Federal Reserve Board also extended the maximum term on discount-window loans to 30 days, rather than the traditional overnight term. Despite these actions, discount-window usage lagged behind that of similar facilities at other major central banks (Borio and Nelson 2008; Armantier, Krieger, and McAndrews 2008). In the US, market observers historically considered discount-window loans a sign of weak balance sheets and efforts to keep borrowing confidential were inadequate (Duke 2010; Armantier et al. 2015; 2011).

In response to continued stress in the interbank market, on December 12, 2007, the Fed announced its first program of what would become the Global Financial Crisis (GFC) (Fed 2007b). The Term Auction Facility (TAF) was the result of the Fed’s efforts to provide discount-window funding to banks without stigmatizing borrowers (FOMC and Fed 2007b). The auction mitigated stigma by increasing the number of borrowers and tweaking features of the discount window that facilitated adverse selection. The TAF allowed a bank to bid through its local Federal Reserve bank for a loan at an interest rate determined by auction (Fed 2009a). The TAF “inject[ed] term funds through a broader range of counterparties and against a broader range of collateral than open market operations,” which were only available to primary dealers (Fed 2007b).

The Federal Reserve Board authorized the TAF on December 10, 2007, under section 10B of the Federal Reserve Act (FOMC and Fed 2007d). Section 10B empowered the Reserve Banks to make a secured loan of not more than four months to a member bank, consistent with rules and regulations enacted by the Board, and as long as the loan was “secured to the satisfaction” of the lending Reserve Bank (Federal Reserve Act 1913, vol. 12, sec. 10B).FMany other programs implemented by the Fed to address the GFC were implemented under its emergency lending authority, which required the Fed to demonstrate “unusual and exigent” circumstances (Federal Reserve Act 1913, vol. 12, sec. 13[3]). Since the TAF was an exercise of the Fed’s core lender-of-last-resort function, it was not required to meet such a standard.

The Fed relied on much of the discount window’s infrastructure for the TAF, and the program originally shared many characteristics with the discount window. TAF loans were offered to depository institutions against the same wide set of collateral that the discount window accepted. And all banks that were eligible for primary credit at the discount window were eligible for the TAF, subject to local Reserve Bank scrutiny (Fed 2007b).

However, some TAF terms were distinct from the discount window. For example, most discount-window loans were overnight, although the Fed had introduced 30-day discount-window loans in August 2007 at the beginning of the crisis and 90-day loans in March 2008 after the failure of Bear Stearns. TAF loans were initially for 28 days; an 84-day loan was added in July 2008. Longer maturities gave borrowers more options and helped ease stress on interbank markets. The TAF also prohibited early repayment of loans, which the discount window allowed for term loans (Fed 2006).

With the longer lending terms, the Fed introduced an additional collateral cushion beyond what its haircut schedule specified. This cushion was initially equal to 100% of the value of collateral after haircuts were applied, effectively doubling the amount of collateral borrowers needed, but, in July 2008, the Fed reduced the size of the collateral cushion to 33% (FOMC and Fed 2008b; Fed 2008a).

The TAF auctioned a preannounced amount using a single-rate mechanism. Prospective borrowers submitted bids through their local Federal Reserve bank. They requested an amount of funds and offered a rate they would pay. The Federal Reserve Bank of New York, which managed the auctions, charged the stop-out rate—just low enough that the amounts requested by bids above that rate exhausted the amount offered—to bidders whose bids were higher than or equal to the stop-out rate and an announced minimum bid rate (Fed 2007b). Bid sizes were subject to a preannounced minimum bid level (originally USD 10 million) and a maximum bid level (10% of the auction amount).

The Fed conducted 60 auctions between December 20, 2007, and March 11, 2010. Until September 2008, the Fed offered between USD 20 billion and USD 75 billion per auction. When Lehman Brothers collapsed on September 15, 2008, interbank funding spreads spiked to their highest levels during the GFC. The Fed offered USD 150 billion in each of the following 22 auctions, providing enough liquidity to satisfy all demand. As a result, the TAF functioned like a standing facility since bids consistently settled at the minimum bid rate. Figure 1 depicts TAF operations, their ultimate sizes, and the bid-cover ratio, which measures total bids as a percentage of the amount offered. Outstanding TAF funds peaked at USD 493 billion in March 2009 and the aggregate amount lent under the program totaled USD 3.8 trillion (Government Accountability Office 2011; Fed 2007–2010a).

Foreign banks, which faced acute dollar funding pressures due to lost returns on dollar-denominated mortgage products and other interbank funding pressures inextricable from US markets, accessed TAF funding through their US branches, which were eligible for the discount window and, thus, also for the TAF (Bernanke 2015, 185). American branches of foreign banks borrowed a large amount from the TAF, approximately two-thirds of the total, or USD 2.5 trillion in aggregate over time (Government Accountability Office 2011; Fed 2007–2010a). Foreign banks also accessed dollar liquidity through foreign central banks that participated in the Fed’s swap lines; these swap lines, in turn, sometimes coordinated the timing and pricing of US dollar funds with TAF operations (Goldberg, Kennedy, and Miu 2011).

Early discussions of the TAF left open the possibility that it could become a permanent facility (Mishkin 2008; FOMC and Fed 2007c). However, by December 2008, FOMC transcripts show that members were anxious about the growing size of the Fed’s balance sheet (FOMC and Fed 2008d). By summer 2009, bids had decreased but still totaled more than USD 10 billion per auction (Fed and Runkel 2007–2010b). The Fed decided to phase out first the 84-day auctions and then, on March 8, 2010, 28-day auctions (FOMC 2010). The Fed suffered no losses on TAF loans.

Figure 1: Term Auction Facility Operations

Source: Fed and Runkel 2007–2010b.

Source: Fed and Runkel 2007–2010b.

The Fed designed the TAF as a lending facility that banks could use for term loans without incurring the discount-window stigma. Its critical feature was that it determined the interest rate through a single-rate auction. Most analysts concluded that the Fed achieved its goal. TAF lending was substantial and far outpaced discount-window lending during the crisis, although the latter did increase despite the perceived stigma (Gilbert et al. 2012, 228–29). For the first three months of the program, TAF borrowing was cheaper than discount-window borrowing. But, after the Fed lowered the costs of discount-window borrowing in March 2008, many banks that were eligible for both were still willing to borrow from the TAF at a premium rather than use the discount window (Armantier et al. 2011). This is illustrated in Figure 2, which shows that, prior to the Lehman bankruptcy in September 2008, the TAF stop-out rate was usually higher than the discount rate.

Figure 2: Percentage of Banks Bidding above the Discount Window Rate at TAF Auctions

Note: On March 16, 2008, the Fed narrowed the spread of the primary credit rate over the target federal funds rate to 25bps.

Note: On March 16, 2008, the Fed narrowed the spread of the primary credit rate over the target federal funds rate to 25bps.

Source: Armantier et al. 2011.

The Fed was successful in managing the risks associated with crisis lending, reporting no losses (Government Accountability Office 2011). Its risk-management measures—the solvency requirement for participants, the haircuts, the collateral cushion, and the seniority of Federal Reserve credit—protected the central bank from counterparty risk throughout the program’s duration (Carlson, Duygan-Bump, and Nelson 2015).

But academic studies disagree on how the TAF affected the interbank term loan rate, specifically its credit-risk and liquidity-risk premia. Taylor and Williams (2009) used an arbitrage-free model that regressed the LIBOR-OIS spread on several explanatory variables. They found no evidence that the TAF significantly affected the liquidity premium. McAndrews, Sarkar, and Wang (2017) argue that Taylor and Williams’ results were invalid since they considered only the absolute level of the LIBOR-OIS spread. By using the change in that spread, McAndrews, Sarkar, and Wang found that the TAF significantly lowered the liquidity premium.

Christensen, Lopez, and Rudebusch (2009) obtain similar results to McAndrews, Sarkar, and Wang using a completely different method. Instead of constructing a linear regression model, Christensen, Lopez, and Rudebusch construct a six-factor arbitrage-free model for decomposing Treasury, bond, and LIBOR yields. Their tests concluded that yields decreased after December 2007, when the TAF made its debut. A counterfactual simulation also found that the three-month LIBOR rate would have been 70 basis points higher than the observed rate if the Fed had not introduced the emergency liquidity measures.

It is uncertain whether the Fed could use the TAF in a similar future crisis. Fed officials thought that the TAF could help diminish stigma because each bank would pay the market-determined rate, not a penalty rate. Also, with many banks participating, it would be less likely that others in the market could guess which banks had participated. However, regulations enacted after the GFC required the Fed to disclose borrower-level data one year after a facility’s closure, potentially making banks less willing to participate (Dodd-Frank Act 2010, sec. 1103[b]). And, after the Fed released TAF borrower data in 2011, there were some critical reports regarding the fact that US branches of foreign banks borrowed 65% of TAF funds (Government Accountability Office 2011; Fed 2007–2010a). Meanwhile, the Fed also made discount-window borrowing harder to trace by combining discount-window loan amounts with other liabilities of banks and non-financial institutions at the Reserve-Bank level. These factors may lessen the value of an auction facility over the discount window.

Key Design Decisions

Purpose

1

At its September 2007 meeting, the Federal Open Market Committee (FOMC) discussed a staff proposal to create an auction-based facility to overcome banks’ reluctance to use the discount window. They also recognized the possibility of creating currency swap lines with foreign central banks to channel dollars overseas to foreign banks with significant US dollar exposures, particularly in mortgage-related assets. FOMC participants expressed the concern that funding liquidity “appears genuinely to be a scarce valuable commodity,” even as banks’ borrowing from the discount window remained limited (FOMC and Fed 2007b). The Board understood that financial institutions had turned instead to the Federal Home Loan BanksFLike the Federal Reserve banks, the 12 FHLBs served banks within their geographic region and lent primarily against home mortgages, mortgage-backed securities, and US government securities to support the mortgage market (see Leonard 2022). (FHLB) for funding, due to the lower cost, longer terms, and lack of stigma of FHLB advances. Some FOMC participants expressed skepticism that an auction would effectively reduce stigma (FOMC and Fed 2007b).

The TAF’s advantage was that it targeted “direct credit to a market that [wa]sn’t working” rather than pumping up credit to the macroeconomy (FOMC and Fed 2007b). Federal Reserve Chair Ben Bernanke also wanted the TAF to address the interbank market’s inability or unwillingness to price risks, but other FOMC participants expressed skepticism that it could achieve this goal. He argued that encouraging loans against the TAF’s wide set of collateral was “totally consistent with Bagehot and the traditions of central bank lending” because it was lending against “undervalued, hard-to-sell, or illiquid assets” that were nonetheless valuable collateral (FOMC and Fed 2007b).

The driving forces behind the TAF were also closely connected to the creation of US dollar swap lines, which are discussed further in Key Design Decision 3. Chair Bernanke noted that “there seems to be an interest from our international partners in working with us with the swap, with activities in other countries, and this TAF seems to be the thing that makes them eager to participate” (FOMC and Fed 2007c). And when the Fed decided in September 2007 to table discussion of the TAF, it was “in light of the ECB’s diffidence” as well as “modest improvements we were seeing in money market functioning,” (Bernanke 2015, p. 163). But financial stress resumed in the fall, and the Fed revived discussion of the TAF. When the Board ultimately voted to create the TAF on December 12, 2007, it did so for the same reasons as it had discussed it in September: “to address elevated pressures in short-term funding markets” (Fed 2007b). The announcement also mentioned that the TAF might help “a broader range of counterparties” than its open-market operations with primary dealers would (Fed 2007b).

Legal Authority

1

The Fed created the TAF under section 10B of the Federal Reserve Act (1913), which provides authority for Federal Reserve banks to lend to member banks, consistent with enacted rules and regulations, provided that the Federal Reserve bank was “secured to its satisfaction.”

To authorize the use of an auction, the Board voted on December 7, 2007, to amend Regulation A, the federal regulation that established rules for Federal Reserve bank credit. Among other things, this amendment allowed the Board of Governors to set auction rules and set the interest rate on TAF funds as the result of that auction (Fed 2007a). This amendment was necessary because Reserve Banks technically held authority to set their own lending rates, subject to review and approval by the Board of Governors (FOMC and Fed 2007b; FOMC and Fed 2007d). For the same reason, every change in the primary and secondary credit rates required approval by the Board.

Part of a Package

1

When the Fed implemented the TAF in December 2007, it was responding to a financial crisis that had already infected the international financial system. Foreign banks’ dollar funding needs exceeded USD 1 trillion due to their substantial cross-currency financial activities before the crisis, particularly in US mortgage-related assets. A contraction in the US interbank market further strained foreign banks (Fender and McGuire 2010; Bernanke 2015, chap. 9). In September 2007, when the Board and FOMC first considered the staff’s proposal for an auction facility to address US market strains, they also discussed how best to get “dollars into European dollar markets” (FOMC and Fed 2007b). Chair Bernanke floated the notion of combining solutions to the two problems at a September joint meeting of the FOMC, which had authority over swaps and the Board:

Some conversations that I had, in particular with President Trichet of the European Central Bank [ECB], came up with the possibility of combining these two things, essentially having auctions simultaneously in the United States and in Europe, and then using the swap markets to provide the dollars to the extent that the ECB would like to have them. The Swiss National Bank [SNB] expressed interest in joining this as well. (FOMC and Fed 2007b)

As a result of further discussions, on the same December day that it announced the TAF, the Fed also announced new swap agreements with the ECB and SNB. Under the agreements, these central banks could swap their respective currency for an equivalent amount of US dollars, returning the same amount of dollars at a predetermined future date. The central banks then auctioned funds to banks in their respective jurisdictions (FOMC and Fed 2008b).

Keeping with the idea that swap lines were a “package deal” dependent on the Fed adopting the TAF, the ECB and SNB coordinated their dollar funding operations with the Fed (FOMC and Fed 2007c). The two central banks offered US dollars the day after TAF auctions, with settlement on the same day as TAF settlements and for the same maturities. As shown in Figure 3, both the TAF and the US dollar swap lines were significant components of the Fed’s response to the GFC (see Wiggins and Metrick 2020). In fall 2008, the Fed added swap agreements with other central banks; eventually the Fed had agreements with 14 central banks. In total, borrowings under the 14 swaps reached a peak of USD 695 billion on October 21, 2008, although the Fed had also committed to providing unlimited dollar liquidity to the ECB, SNB, Bank of England, and Bank of Japan (Wiggins and Metrick 2020).

Some of the swap counterparties also offered US dollar lending on the same days as TAF auctions (Wiggins and Metrick 2020). The ECB, SNB, Norges Bank, the Bank of Japan, and the Bank of Korea conducted swaps with settlement and maturity dates that matched 48 TAF operations (Fed 2007–2010c; Fed and Runkel 2007–2010b). Coordination extended to policy changes; when the TAF introduced 84-day loans, the ECB and SNB also introduced 84-day terms to their dollar-liquidity auctions (FOMC and Fed 2008b). The ECB sometimes charged participants a rate equal to the stop-out rate in TAF auctions, provided by the FRBNY before it was announced publicly (Goldberg, Kennedy, and Miu 2011; Fed and Runkel 2007–2010b; ECB 2021). When the coordination factors are considered in aggregate, the connection between the TAF and these auctions is clear. For example, on November 18, 2008, outstanding swap agreements with settlement and maturity dates matching those of TAF operations totaled USD 445 billion, rivaling the size of the TAF (Fed 2007–2010c; Fed and Runkel 2007–2010b).

However, it is important to acknowledge the different trajectories of the two programs. Any such coordination of actions was decided by the foreign central bank and not dictated by the Federal Reserve. Moreover, swap usage became less correlated with TAF operations over time (Fed 2007c; Fed 2007–2010c; Fed and Runkel 2007–2010b).

The Fed sometimes announced changes to domestic programs when it changed the TAF, but the changes did not interact with the TAF in the way that the swap lines did. These changes included rate cuts when the program was announced in 2007 and a slew of programs around the collapse of Lehman Brothers in fall 2008.

Figure 3: Federal Reserve System Credit Allocation During the GFC

Sources: Author’s calculation; Fed 2007c.

Sources: Author’s calculation; Fed 2007c.

Management

1

The TAF was authorized by the Fed Board and any changes to it other than purely operational matters, such as the introduction of 84-day credit, were also approved by the Board (Fed 2007b; Fed 2008f). Management of the TAF was split between the Board of Governors and the 12 Federal Reserve banks. Before each auction, the Board announced the amount offered, minimum bid rate, and other terms. Participants bid through their local Federal Reserve bank, which then sent the bids to the Markets Group of the Federal Reserve Bank of New York to be compiled and accepted (Fed 2008a). Disbursements were made through the local Reserve banks.

Administration

1

The TAF auction process typically lasted a whole week; one FOMC participant noted that this extended timeline helped address the stigma problem, saying, “If you have to submit your bid on Monday to get awarded on Thursday, this is not the action of a bank that’s desperate for funding” (FOMC and Fed 2007b). A typical Friday started with the Board of Governors announcing the amount offered, minimum rate, and terms (Fed 2008a).

On Monday, participants then called their local Federal Reserve bank’s discount-window hotline to place bids, which were then relayed to the Federal Reserve Bank of New York. The New York team calculated the stop-out rate by accepting bids starting with those offering the highest interest rate, then the next highest rate, and so on, until either the accepted bid amounts exhausted the amount offered, or bid rates dropped below the minimum rate (Fed 2008a). The lowest accepted bid was the stop-out rate, paid by all bidders (Fed 2009a).

On Tuesday, the Fed announced the results of the auction, notified the successful bidders, and, on Thursday, Reserve Banks credited the accounts of successful bidders to settle (Armantier, Krieger, and McAndrews 2008; Fed 2009a). When loans matured, either 28 or 84 days after settlement, the borrower paid the stop-out rate as interest (Fed 2009a).

Before and after the auction, the TAF relied on the existing discount-window infrastructure. Discount-window staff were already in place to screen collateral, and the Reserve Banks had prior relationships with the banks in their district (FOMC and Fed 2007b). Participating banks agreed to the same borrowing terms, under Operating Circular 10 (OC-10), that were required for discount-window borrowing (Fed 2009a). By using much of the discount-window infrastructure, the Fed sought to make the program “simple” to counterparties facing a new facility yet “robust” enough for reliable operations of large loan amounts (FOMC and Fed 2007b).

Figure 4: Sample Auction Results

Source: Fed and Runkel 2007–2010b.

Eligible Participants

2

Depository institutions that were “eligible for primary credit—that is, those determined by the lending Reserve Bank to be in generally sound financial condition”—were eligible to bid at TAF auctions (Krieger 2007). The Fed determined eligibility for primary credit based on the bank’s most recent examination, which resulted in a CAMELSFThe CAMELS rating measured capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk on a scale of 1 (the best) to 5 (the worst) (Armantier, Krieger, and McAndrews 2008). rating that the Fed could access even when it was not a bank’s primary supervisor. The TAF, like the primary credit facility, accepted CAMELS ratings of 1, 2, or 3, the highest ratings (Armantier, Krieger, and McAndrews 2008). The Board considered and rejected a higher standard where a bank would need to be “well capitalized but also well managed” to qualify for the TAF (FOMC and Fed 2007b). However, such a standard would likely only have excluded a few banks. Moreover, the FOMC was concerned that, by excluding banks from the TAF, the Fed would inadvertently stigmatize them and worsen their liquidity problems (FOMC and Fed 2007b).

In total, 416 banks participated in the TAF. Their peak outstanding borrowings ranged from USD 1.4 million for First Merchant Bank, to USD 60 billion for Bank of America (Fed 2007–2010a).

The FOMC debated allowing US branches of foreign banks to participate in the TAF. Concern centered around two points, (i) possible double-dipping, whereby such a branch would borrow funds under the TAF while also benefitting from the Fed’s US dollar swaps with various foreign central banks, and (ii) concern that the Fed could more accurately gauge whether a US bank was creditworthy, as opposed to a branch of a foreign one (FOMC and Fed 2007b).

The Board decided that US branches of foreign banks would be permitted to participate for several reasons, but primarily because excluding them from the TAF would have constituted “a huge change in” how the Fed treated foreign financial institutions (FOMC and Fed 2007b). Moreover, many US banks also had foreign subsidiaries that could participate in other central banks’ liquidity facilities, which put the US banks in a similar position with respect to the possibility of double-dipping (FOMC and Fed 2007d).

Even with large liquidity swap lines, US branches of foreign banks borrowed 65% of all funds auctioned under the TAF (Government Accountability Office 2011). Acharya, Afonso, and Kovner (2013) argue that foreign banks with a presence in the US turned to the TAF because it was the only large source of liquidity open to them. Foreign banks saw a smaller increase in deposits than US banks, and foreign banks couldn’t access advances from the FHLB (see Leonard 2022). Acharya, Afonso, and Kovner (2013) also connect foreign-bank liquidity problems to the pre-TAF period, suggesting that the TAF put foreign banks and US banks on more even footing to face the Global Financial Crisis. It is not clear how much of such funding was used by US branches for their own funding needs compared to the funding needs of their parents abroad.

No FOMC meeting transcripts going back to September 2007 mentioned opening eligibility to primary dealers, which already had access to open-market operations. Further, the Fed had, in 2007, already exempted specific banks from restrictions on funneling liquidity to affiliated dealers (Omarova 2011). TAF recipients could, under this exemption, send funds to their affiliates while borrowing from the program.

Funding Source

1

Successful TAF bidders received credits in the accounts they held at their local Federal Reserve bank (Fed 2008a).

Program Size

1

The Fed increased the program total in response to market conditions. As shown in Figure 5, the TAF operated with a program total allocated across auctions held every two weeks. When the term was limited to 28 days, this program total equaled the sum of the authorizations of two consecutive auctions. Initially, the TAF was authorized to auction USD 20 billion every two weeks, for a total of USD 40 billion. Between December 2007 and April 2008, the amount offered for each auction increased to USD 75 billion, bringing the program’s total authorization to USD 150 billion. When it added the 84-day loans in July and began alternating between auctions of 28- and 84-day loans, it modified the amount offered in 28-day auctions to maintain an authorized amount of USD 150 billion (Fed 2007–2010a; Fed 2008f).

Figure 5: Total Authorizations and Offerings Per Auction for Selected Dates

* Amounts varied to stay within authorized amount. Sources: Fed 2008b; Fed 2008c; Fed 2008e; Fed 2008f; Fed 2008g; Fed 2009c; Fed 2009d; Fed 2009e; Fed 2009f.

* Amounts varied to stay within authorized amount. Sources: Fed 2008b; Fed 2008c; Fed 2008e; Fed 2008f; Fed 2008g; Fed 2009c; Fed 2009d; Fed 2009e; Fed 2009f.

Every auction before October 2008 was oversubscribed—sometimes doubly so—which pushed out some bidders. Oversubscribed auctions were part of the Fed’s stigma strategy, since institutions could not ensure they would receive funds. The Lehman bankruptcy and the failure of several other major US institutions re-prioritized the size of the TAF over its effects on stigma. The Fed announced that, beginning with the October 6 auction, it would triple the amount offered in its 84-day auction to USD 75 billion (increasing to a total of USD 225 billion in that maturity) while maintaining the 28-day auctions at USD 25 billion. The Board said it was taking these steps to “reassure financial market participants that financing will be available against good collateral, lessening concerns about funding and rollover risk” (Fed 2008g). After total bids for the October 6 auction topped USD 130 billion, the Fed increased the auction offer to USD 150 billion for that auction and future auctions of both the 28-day and 84-day maturities (Fed 2007–2010a; Fed 2008g).

These increased offerings were able to provide full allotment to all bidders, effectively mirroring the strategy of the European Central Bank’s longer-term refinancing operations (known as LTROs) (FOMC and Fed 2008c; Runkel 2022). Offering amounts remained at USD 150 billion until July 2009 (Fed 2007–2010a). The tumultuous period between August and October 2008 is presented in Figure 4.

Individual Participation Limits

1

The final terms for the TAF set the maximum bid amount, aggregated across all US branches of a bank, to 10% of the amount offered (Fed 2008a; Fed and Runkel 2007–2010b). That is, a bank with branches or affiliates in other Federal Reserve districts could only bid up to a combined 10% of the total amount offered. The Fed’s original proposal was modeled on prior auctions for Treasury securities, which had maximum bid sizes of 35% (Krieger 2007; FOMC and Fed 2007b). Following this model, the Fed proposed a maximum bid amount of 20%, but FOMC participants expressed concerns that five risky institutions would take the entire allotment. This could cause political problems if the Fed was seen as propping up risky or foreign institutions instead of American markets (FOMC and Fed 2007b).

The original design of the TAF required a minimum bid of USD 50 million. FOMC participants expressed concerns that this would exclude small banks, giving large banks favorable financing (FOMC and Fed 2007b). Before the first TAF operation was announced, the Fed lowered the minimum bid to USD 10 million to accommodate “the desired bid sizes of smaller institutions” (FOMC and Fed 2007c). The Fed applied the same logic when it lowered the minimum bid to USD 5 million ahead of the February 11, 2008, operation (FOMC and Fed 2008a).

Rate Charged

1

The Fed chose to use a single-price auction to simplify settlement and encourage aggressive bidding, since successful bidders paid the stop-out rate instead of the rate they bid (Armantier, Krieger, and McAndrews 2008). See Key Design Decision No. 5, Administration, for more details on this. In this format, FRBNY compiled all bids and accepted them, starting with the highest rates bid, until the sum requested by accepted bids exhausted the total amount offered in the auction. Then, all bidders paid the single rate equal to the lowest accepted bid.

Minimum bid rates were set by the Board of Governors prior to each auction announcement. Originally the Fed used 10bps over the Overnight Index Swap (OIS)—which was approximately the one-month federal funds rateFBanks with reserves in excess of Fed requirements lent to other banks overnight in the federal funds market; the Fed’s target for that rate was one of its key monetary policy tools.—as the minimum bid rate (FOMC and Fed 2007b). The LIBOR-OIS spread had widened, so the TAF would allow banks to borrow at a rate above the OIS (to account for term and risk premia) but below the LIBOR, which had risen to prohibitive levels. As one FOMC participant said, “You could actually criticize a bank for not participating in this. They are somehow leaving money on the table by not taking advantage of” these low interest rates, which could encourage perfectly healthy banks to bid for funds (FOMC and Fed 2007b). With the amount of bidders—including healthy bidders—that bid for TAF funds, all auctions that were undersubscribed settled at the minimum bid rate.

But this low minimum created an arbitrage opportunity. By December 2008, the Fed had begun paying 0.25% interest on excess reserve balances but the target federal funds rate had dropped to between 0 and 0.25% (FOMC 2008). Banks could borrow from the TAF and then lend the Fed its own money at a profit. To avoid such arbitrage, in January 2009 the Fed switched the minimum bid rate from the OIS to the interest rate on reserve balances (Fed 2009b).

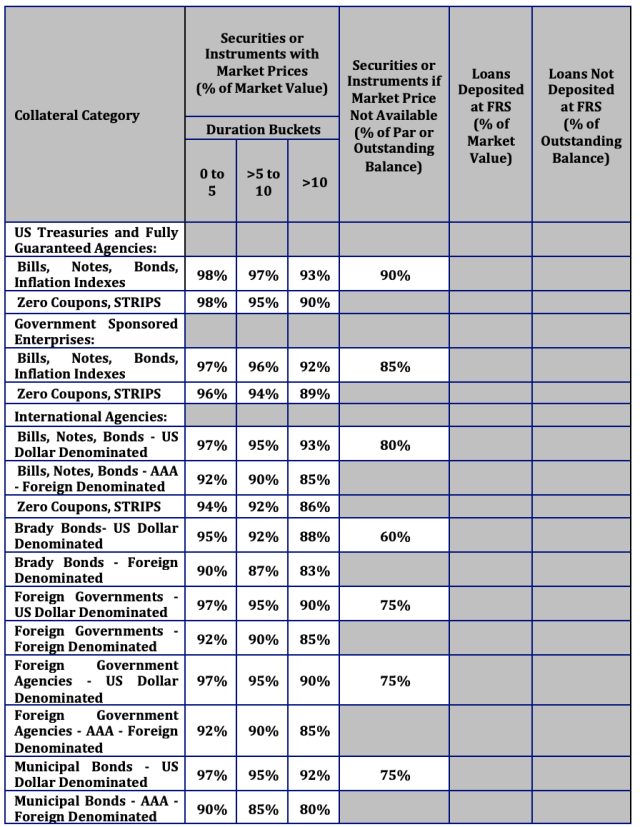

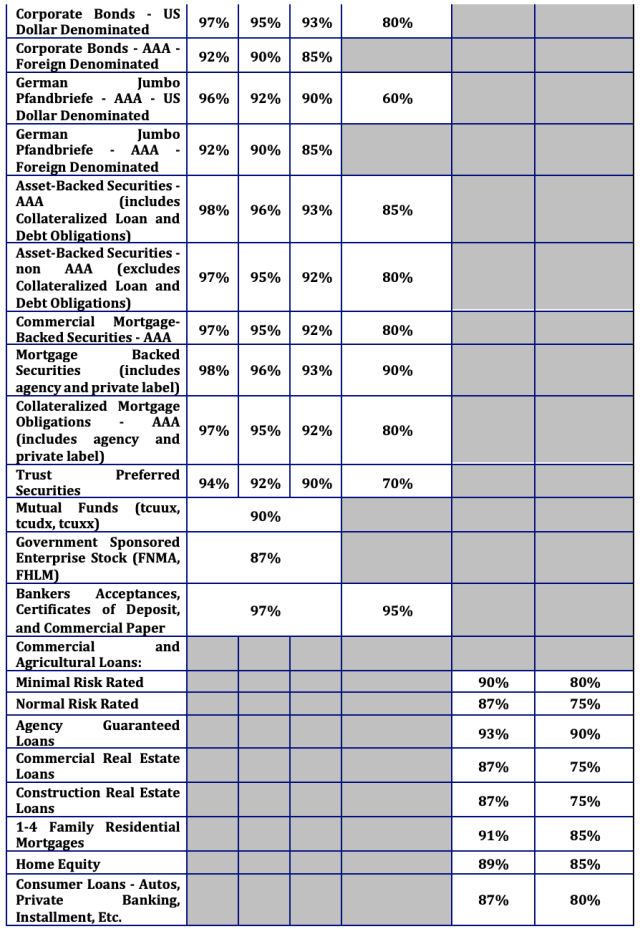

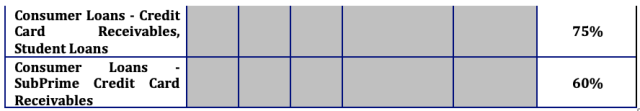

Eligible Collateral or Assets

1

The discount window accepted a wide set of collateral, as shown in the Appendix. Like discount-window borrowers, potential TAF borrowers had to deposit collateral with their local Federal Reserve bank before borrowing, and such collateral was subject to haircuts—shown in the Appendix—to determine a participant’s maximum bid. Because the Federal Reserve bank staff regularly administered the discount window rules regarding collateral, they could quickly and efficiently assess and value collateral deposited for TAF borrowings and implement TAF auctions (FOMC and Fed 2007b). In practice, nominal collateral value (i.e. before haircuts) averaged 513% of loan value. As shown in Figure 6, borrowers pledged large amounts of commercial loans, asset-backed securities, mortgage-backed securities, and residential mortgages. On the other hand, borrowers pledged small amounts of their safest assets: US Treasury bills and government bonds (Fed 2007–2010a).

Figure 6: Portion of Collateral Pledged by Asset Class

Source: Fed 2007–2010a.

Source: Fed 2007–2010a.

TAF required a collateral cushion on top of the standard haircuts. Originally, participants had to provide double the collateral normally required, but were only required to maintain that collateral for the term of the bidding process. This ensured borrowers some flexibility if they incurred overdrafts before settlement. The Fed did not apply the same cushion to term discount-window loans (FOMC and Fed 2008b).

In July 2008, when the Fed added 84-day loans, it decreased the size of the collateral cushion to 33% of the collateral value. In doing so, the Fed also required the cushion to remain on deposit for the term of the loan after it learned that some banks withdrew the collateral cushion after being awarded the TAF loan (FOMC and Fed 2008b; Fed 2008a). At the same time, the Fed stipulated that term discount-window loans would also bear the same cushion requirement. If the collateral value on deposit fell below 133% of the loan value, the borrowing bank was required to cover the shortfall within two business days (Fed 2009a). If it did not, the Reserve Bank could exercise its rights to recourse (Government Accountability Office 2011). The Fed also considered revising their haircut schedule but demurred after considering possible negative market consequences (FOMC and Fed 2008b).

Loan Duration

1

The TAF initially only auctioned 28-day loans to backstop the interbank term lending market. Fed staff research connected the collapse of mortgage-backed and asset-backed products with increases in bid-ask spreads for term funding, specifically in one-month terms (FOMC and Fed 2007b). Setting the term at 28 days allowed the Fed to conduct auctions on the same weekday without increasing the program’s total authorization. It also brought the maturity of the new facility close to the maximum term on discount-window loans.

In March 2008, the Federal Reserve Board extended the maximum term of discount-window loans from 30 to 90 days, amongst a package of measures following the near-failure of Bear Stearns (Fed 2008d). In July, the Fed extended the maximum term of TAF loans to 84 days. New York Fed President William Dudley explained:

The motivation for the maturity extension is to provide greater support to term funding markets. For some time, banks have asked for longer-term maturity TAF loans. This is attractive to them for two reasons: (1) almost all of these loans will extend over quarter-ends—periods in which balance sheet stress is likely to be greatest—and (2) the longer maturity would also help banks extend the average maturity of their borrowings. This change will also put the maturity of TAF loans more on par with the ninety-day limit of the primary credit facility (FOMC and Fed 2008b, 5).

In July 2008, when Fed staff originally proposed extending the term of all TAF loans to 84 days, FOMC participants expressed concerns over increased credit risk to the Reserve Banks. These concerns ultimately led to the increased collateralization requirements discussed in Key Design Decision 12, but FOMC participants discussed augmenting the supervisory information that Reserve Banks had with information from other regulators as an alternative way of limiting credit risk in 84-day loans. Though Armantier, Krieger, and McAndrews (2008) noted that the Fed may hold an informational advantage over the creditworthiness of banks in crisis due to its access to information about a bank’s fundamentals, FOMC officials were concerned about how risks increased with the length of maturity. FOMC participants expressed fears over fully relying on other regulators to assess banks after the FDIC failed to alert the Federal Reserve Bank of San Francisco of the health of an institution it nearly accepted for primary credit (FOMC and Fed 2008b).

With the introduction of the 84-day loans, the Fed continued biweekly TAF auctions but alternated between offering 28-loans and 84-day loans. It maintained the amount of liquidity outstanding at USD 150 billion—divided equally between the two maturities—until October 2008 when it significantly increased the size of the 28-day and 84-day loan auctions (Fed 2008f; FOMC and Fed 2008b). TAF loans of any term could not be paid off before maturity (Fed 2009a). TAF funds of 28- and 84-day duration aligned with reserve maintenance periods, over which the Fed calculated whether banks met the regulatory reserve requirement; periods began on a Thursday and ended two Wednesdays later.

Other Conditions

1

Documents surveyed do not indicate further restrictions on bidders.

Impact on Monetary Policy Transmission

1

The Fed chose an auction in part because it allowed the Fed to control when and how much it increased the supply of reserve balances (FOMC and Fed 2007c). By prohibiting early repayment and using fixed-term loans that were not subject to the rollover risks associated with discount-window lending, the Fed could also control when and how much it decreased the supply of reserves when TAF loans matured. This let the open-market desk face “minimal uncertainty” about the TAF’s effects on monetary policy implementation (Mishkin 2008). For example, to offset the injection of USD 75 billion of reserves into the financial system in the form of TAF loans, FRBNY could sell USD 75 billion of Treasury securities through its open-market operations to sterilize the increase in reserves (Government Accountability Office 2011). To further influence reserve balances, the Fed set the minimum bid rate equal to the rate offered for interest on excess reserves (see Key Design Decision No. 11, Rate Charged).

Other Options

1

Before the TAF was authorized in December 2007, the Fed announced changes to make the discount window more attractive. In August, the Board reduced the penalty on discount-window loans—represented by the spread between the primary credit rate at the discount window and the federal funds rate—from 100bps to 50bps. It also extended the possible length of discount-window loans to 30 days plus a possible renewal (Armantier, Krieger, and McAndrews 2008). In March 2008, before the introduction of 84-day TAF funds, the Fed extended the possible length of discount-window loans to 90 days (Fed 2008d). Discount-window usage did not increase appreciably after these changes despite continued tightening in the interbank market (Fed 2007c).

In debating the TAF on December 6, FOMC participants also considered two alternatives: further reducing the discount-window penalty; or, adopting a term credit program that would allow banks to request credit at the discount window. Fed staff argued that the auction had several advantages. First, the TAF allowed the Fed to strictly control how much it increased the supply of reserve balances, whereas the discount window largely allows banks to determine how much they borrow. Second, an auction included several features that promised to reduce stigma over standing facilities. Third, by releasing funds at discrete intervals, the Fed could monitor if and how the auctions changed market conditions and respond before the next auction. A temporary TAF could also allow the Fed to explore the possibility of a permanent term auction credit facility (FOMC and Fed 2007c).

FOMC participants also raised the possibility of cutting discount-window borrowing rates and operating-term repurchases that covered only the end of 2007. They doubted the ability of the TAF to relieve pressure in ways that the FHLB and discount window had not. Further, they wondered if the interbank market would quickly find a new equilibrium. But the Fed had received interest in the TAF from other central banks, and Chair Bernanke noted that they “were not interested, explicitly, in participating if we were involving only a discount rate cut or any other action” (FOMC and Fed 2007c).

Similar Programs in Other Countries

1

Many central banks expanded term-lending programs and at least one addressed stigma, but no other central bank successfully combined the two. In 2008, the Bank of England split its standing facility into two new standing facilities due to stigma. The Discount Window Facility (DWF) was most similar to the TAF, offering banks loans of up to 30 days (later increased to 364 days). Banks pre-positioned more than £265 billion of collateral with the DWF, but the facility was not used (Fulmer 2022).

As shown in Figure 7, large central banks used long-term open-market operations to combat the GFC, though only the DWF and TAF sought to overcome stigma issues (Borio and Nelson 2008). The Eurosystem, headed by the European Central Bank, expanded its term refinancing operations in both allotment and maturities. These operations used a multi-rate auction until October 2008, when it satisfied all bids at a policy rate. The term refinancing saw similar usage as the TAF, with more than €700 billion outstanding at their peak (Runkel 2022).

Figure 7: Comparison of Crisis Policy Changes

Note: The headers denote countries surveyed and are, from left to right, Australia, Canada, the eurozone/euro area, Japan, Switzerland, the UK, and the US.

Note: The headers denote countries surveyed and are, from left to right, Australia, Canada, the eurozone/euro area, Japan, Switzerland, the UK, and the US.

Source: Borio and Nelson 2008.

Communication

1

Market participants anticipated that the Fed would create a facility aimed at the interbank market. When the Fed did not announce such a facility in the December 11 statement following its meeting, stocks slumped. But the Fed had been waiting to announce the TAF simultaneously with the central banks of England, Japan, Canada, the ECB, and the SNB. The Fed chair wrote that the ECB had requested participating central banks announce the currency lines and TAF simultaneously to emphasize their coordination rather than emphasizing the one-sidedness of dollars flowing from the Fed abroad (Bernanke 2015, 184). On December 12, 2007, the central banks of the UK, Japan, the eurozone, Canada, and Switzerland joined the Fed in announcing measures to increase liquidity (BoC 2007; Bank of England 2007). For the ECB and SNB, these announcements included the dollar swap lines and auctions (ECB 2007; SNB 2007). Later, these central banks would follow the TAF’s lead and announce 84-day US-dollar loans (FOMC and Fed 2008b).

Bernanke (2015, 185) recognized the announcement of the TAF as the start of increased communication from the Fed. By doing so, the Fed intended to enlarge its role as a communicator and influence market reactions more frequently.

Disclosure

1

The Fed released aggregated results of each auction the following day. These notices included the amount awarded, the number of bidders, the stop-out rate, and the bid-to-cover ratio (Fed and Runkel 2007–2010b). Also, each Wednesday the Fed published outstanding TAF and discount-window loans in each Fed region, a practice it had long done for discount-window loans prior to the crisis (Fed 2007c).

The Fed did not release data about specific institutions and told banks that it would not release such data, “except as required by law” (Fed 2009a). Institutional data regarding TAF borrowings was only released in December 2010 after Bloomberg LP brought a Freedom of Information Act challenge against the Fed (Bloomberg L.P. v. Board of Governors of the Federal Reserve System 2009). The Fed then released data specifying institution, borrowing amount, and collateral supplied (Fed 2007–2010a). This disclosure revealed the heavy usage of the TAF by US branches of foreign banks.

Stigma Strategy

1

The TAF’s single-price auction format introduced several features to combat the discount window’s stigma. Since the Fed discouraged use of the facility throughout the 20th century, market participants began to view credit from Federal Reserve banks, which “in normal times is rare . . . as a sign of weakness” (Duke 2010; Armantier, Lee, and Sarkar 2015). Though discount-window loans were ostensibly confidential, banks could triangulate the borrower based on the size of the loan, the district, and information gathered from colleagues and friends at other banks (Duke 2010; Armantier et al. 2015). Knowing—or suspecting—that a bank borrowed from the discount window damaged a bank’s chances at securing private financing “as the market trie[d] to identify the weaker players” (Duke 2010).

TAF auctions did not give market participants this sort of knowledge. Since loans settled simultaneously, no bank could be singled out if multiple banks received funds. And, as long as demand was sufficiently high, the maximum bid amount meant that at least ten banks per auction received funds. The Fed stimulated demand by setting the minimum price below LIBOR and the federal funds rate. This feature attacked the view that participating banks were distressed, since “banks would not necessarily signal an abnormally high demand by bidding” (FOMC and Fed 2007b; Armantier, Krieger, and McAndrews 2008). Moreover, distressed banks couldn’t rely on the TAF since some bidders did not win funds, and loans settled three days after the auction (Mishkin 2008).

Exit Strategy

1

Early discussions of the TAF left open the possibility that it could become a permanent facility (Mishkin 2008; FOMC and Fed 2007c). Unlike most of the Federal Reserve’s other programs, the TAF did not have an end date and could, legally, continue regardless of whether the financial system faced “unusual and exigent circumstances” (FOMC and Fed 2009a). However, by December 2008, FOMC transcripts show that members were anxious about the growing size of the Fed’s balance sheet. Nonetheless, while Fed staff believed the TAF “should downsize pretty automatically” as participants stopped seeking funds in favor of lower alternatives and more flexibility (FOMC and Fed 2008d). By summer 2009, TAF auctions had decreased but still provided tens of billions of dollars in liquidity per operation (Fed and Runkel 2007–2010b). In its September 2009 meeting, Fed staff first proposed a gradual reduction in offering amounts (FOMC and Fed 2009a). The Fed decided then to phase out 84-day auctions by shortening the maturities first to 70 days, and then removing credit longer than 28 days altogether (FOMC and Fed 2009b). On January 27, 2010, the FOMC announced the wind-down of several GFC programs including the TAF, specifying the final two amounts offered (USD 50 billion and USD 25 billion) and dates (February 8 and March 8) when they also raised the minimum bid rate (FOMC 2010).

Key Program Documents

-

(Armantier, Krieger, and McAndrews 2008) Armantier, Olivier, Sandra Krieger, and James McAndrews. 2008. “The Federal Reserve’s Term Auction Facility.” Current Issues in Economics and Finance 14, no. 5: 1–11.

NY Fed review of the TAF.

-

(ECB 2007) European Central Bank (ECB). 2007. “Measures Designed to Address Elevated Pressures in Short-Term Funding Markets,” December 12, 2007.

ECB Press release on coordinated G10 actions to address liquidity pressures in funding markets.

-

(Fed 2006) Federal Reserve System (Fed). 2006. “Lending.” Operating Circular 10. October 15, 2006.

Standard agreement between the Fed and member banks before discount window (or, in this case, TAF) lending was authorized.

-

(Fed 2008a) Board of Governors of the Federal Reserve System (Fed). 2008a. “Terms and Conditions for Term Auction Facility.” July 30, 2008.

Technical overview of the TAF.

-

(Fed 2009a) Board of Governors of the Federal Reserve System (Fed). 2009a. “Term Auction Facility Questions and Answers.” January 12, 2009.

Document answering technical questions about the administration of the TAF.

-

(Federal Reserve System 2006) Federal Reserve System. 2006. “Discount and PSR Collateral Margins Table.” September 22, 2006.

Haircut schedule and table of normally accepted collateral at the discount window.

-

(FOMC and Fed 2007a) “Conference Call” (FOMC and Fed). 2007a.

FOMC transcript discussing developments at the start of the Global Financial Crisis.

-

(Bloomberg L.P. v. Board of Governors of the Federal Reserve System 2009) 2009. . US District Court for the Southern District of New York (No. 1:2008cv09595). Justia.

Lawsuit compelling the Fed to release usage data from programs such as the TAF.

-

(Dodd-Frank Act 2010) U.S. Congress (Dodd-Frank Act). 2010. Dodd-Frank Wall Street Reform and Consumer Protection Act. 849. Congress: 111–203.

Legislation creating several reforms and amendments in the wake of the Global Financial Crisis.

-

(Fed 2007a) Board of Governors of the Federal Reserve System (Fed). 2007a. 12 CFR 201: Extensions of Credit by Federal Reserve Banks. Final Rule (No. R-1304). 72 Federal Register 71202.

Final rule establishing the TAF and building on prior versions of Regulation A.

-

(Federal Reserve Act 1913) An Act to Provide for the Establishment of Federal Reserve Banks, to Furnish an Elastic Currency, to Afford Means of Rediscounting Commercial Paper, to Establish a More Effective Supervision of Banking in the United States, and for Other Purposes. 1913. 12 U.S.C. Congress 63–43.

Statute granting the Fed authority to lend to member banks against collateral.

-

(Bank of England 2007) Bank of England. 2007. “Central Bank Measures to Address Elevated Pressures in Short-Term Funding Markets.” December 12, 2007.

Press release explaining the first round of ELTRs.

-

(Armantier et al. 2011) Armantier, Olivier, Eric Ghysels, Asani Sarkar, and Jeffrey Shrader. 2011. “Is There Stigma to Discount Window Borrowing?” Liberty Street Economics (blog). August 31, 2011.

Blog post empirically examining the presence of stigma in the Fed’s discount window.

-

(BNP Paribas 2007) BNP Paribas. 2007. “BNP Paribas Suspends NAV Calculation.” Financial Crisis Inquiry Commission, BNP Paribas. Yale Program on Financial Stability Resource Library. August 9, 2007.

Press release announcing that BNP Paribas would not price net asset value in a fund heavily exposed to US subprime mortgages and marking the start of the Global Financial Crisis.

-

(BoC 2007) Bank of Canada (BoC). 2007. “Bank of Canada Temporarily Expands List of Securities Eligible for Term PRA Transactions.” December 12, 2007.

Press release announcing Term PRA facility alongside other G10 actions.

-

(Duke 2010) Duke, Elizabeth A. 2010. “Unusual and Exigent: My First Year at the Fed.” Remarks presented at the Economics Club of Hampton Roads, Norfolk, Virginia, February 18, 2010.

Speech by former banker and then-Richmond Fed governor about discount-window stigma.

-

(Fed 2007) Board of Governors of the Federal Reserve System. 2007. “Federal Reserve Board Discount Rate Action.” August 17, 2007.

Press release announcing a 50-basis-point reduction in the primary credit rate to 5-3/4 percent “To promote the restoration of orderly conditions in financial markets.”

-

(Fed 2007b) Board of Governors of the Federal Reserve System (Fed). 2007b. “Federal Reserve and Other Central Banks Announce Measures Designed to Address Elevated Pressures in Short-Term Funding Markets.” December 12, 2007.

Federal Reserve press release on coordinated G10 liquidity actions.

-

(Fed 2008b) Board of Governors of the Federal Reserve System (Fed). 2008b. “Federal Reserve Will Conduct Two Auctions of 28-Day Credit through Its Term Auction Facility in January.” January 4, 2008.

Press release announcing auctions, including their sizes.

-

(Fed 2008c) Board of Governors of the Federal Reserve System (Fed). 2008c. “Federal Reserve Announces Two Initiatives to Address Heightened Liquidity Pressures in Term Funding Markets.” March 7, 2008.

Press release announcing an increase in outstanding TAF authority to USD 50 billion.

-

(Fed 2008d) Board of Governors of the Federal Reserve System (Fed). 2008d. “Federal Reserve Announces Two Initiatives Designed to Bolster Market Liquidity and Promote Orderly Market Functioning.” March 16, 2008.

Press release announcing, among other things, that discount window credit could now be sought for up to 90 days.

-

(Fed 2008e) Board of Governors of the Federal Reserve System (Fed). 2008e. “Federal Reserve, European Central Bank, and Swiss National Bank Announce an Expansion of Liquidity Measures.” May 2, 2008.

Press release announcing larger swap lines.

-

(Fed 2008f) Board of Governors of the Federal Reserve System (Fed). 2008f. “Federal Reserve Announces Steps to Enhance the Effectiveness of Its Existing Liquidity Facilities.” July 30, 2008.

Press release announcing 84-day TAF loans.

-

(Fed 2008g) Board of Governors of the Federal Reserve System (Fed). 2008g. “Federal Reserve and Other Central Banks Announce Further Coordinated Actions to Expand Significantly the Capacity to Provide U.S. Dollar Liquidity.” September 29, 2008.

Press release announcing actions in the wake of the collapse of Lehman Brothers, including an enormous increase in TAF auctions, from USD 25 billion to USD 75 billion, as well as more TAF auctions, and a USD 330 billion expansion of swap lines.

-

(Fed 2009b) Board of Governors of the Federal Reserve System (Fed). 2009b. “Federal Reserve Will Offer $150 Billion in 28-Day Credit through Its Term Auction Facility Today.” January 12, 2009.

Press release announcing a TAF auction and changing the minimum bid rate to equal the interest rate paid on excess reserves.

-

(Fed 2009c) Board of Governors of the Federal Reserve System (Fed). 2009c. “Federal Reserve Announces Extensions of and Modifications to a Number of Its Liquidity Programs.” June 25, 2009.

Press release announcing TAF auction dates and sizes.

-

(Fed 2009d) Board of Governors of the Federal Reserve System (Fed). 2009d. “Federal Reserve Announces That Amounts of Term Auction Facility (TAF) Credit Offered at Each of the Two August Auctions Will Be Reduced to $100 Billion.” July 24, 2009.

Press release announcing a step in the wind-down of the TAF.

-

(Fed 2009e) Board of Governors of the Federal Reserve System (Fed). 2009e. “Federal Reserve Announces Amounts of Term Auction Facility (TAF) Credit Offered at September Auctions Will Be Reduced to $75 Billion.” August 28, 2009.

Press release announcing a step in the wind-down of the TAF.

-

(Fed 2009f) Board of Governors of the Federal Reserve System (Fed). 2009f. “Federal Reserve Announces Term Auction Facility (TAF) and Term Securities Lending Facility (TSLF) Schedules through January 2010.” September 24, 2009.

Press release detailing schedules of the TAF and TSLF, including some of the last TAF auctions.

-

(FOMC 2008) Federal Open Market Committee (FOMC). 2008. “FOMC Statement.” December 16, 2008.

The Federal Open Market Committee decided to establish a target range for the federal funds rate of 0 to 1/4 percent.

-

(FOMC 2010) Federal Open Market Committee (FOMC). 2010. “FOMC Statement.” January 27, 2010.

Press release announcing the wind-down of several GFC programs including the final TAF auction.

-

(FOMC and Fed 2007b) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2007b. “Meeting.” September 18, 2007.

Transcript of FOMC meeting in which the TAF is first proposed.

-

(FOMC and Fed 2007c) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2007c. “Conference Call.” December 6, 2007.

FOMC transcript renewing discussion of the TAF.

-

(FOMC and Fed 2007d) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2007d. “Meeting.” December 11, 2007.

FOMC transcript approving the TAF and finalizing its terms.

-

(FOMC and Fed 2008a) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2008a. “Meeting.” January 29, 2008.

FOMC transcript lowering the minimum bid to USD 5 million.

-

(FOMC and Fed 2008b) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2008b. “Conference Call.” July 24, 2008.

FOMC transcript adding 84-day funds.

-

(FOMC and Fed 2008c) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2008c. “Conference Call.” October 7, 2008.

FOMC transcript discussing further measures to shore up confidence.

-

(FOMC and Fed 2008d) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2008d. “Meeting.” December 15, 2008.

FOMC transcript discussing the TAF’s exit strategy.

-

(FOMC and Fed 2009a) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2009a. “Meeting.” September 22, 2009.

FOMC transcript in which Fed staff first proposed a gradual reduction in offer amounts.

-

(FOMC and Fed 2009b) Federal Open Market Committee and Board of Governors of the Federal Reserve System (FOMC and Fed). 2009b. “Meeting.” November 3, 2009.

FOMC transcript finalizing details of the TAF wind-down.

-

(Mishkin 2008) Mishkin, Frederic S. 2008. “The Federal Reserve’s Tools for Responding to Financial Disruptions.” Speech presented at the Tuck Global Markets Conference, Tuck School of Business, Hanover, NH, February 15, 2008.

Speech by Board member discussing the TAF and other GFC tools.

-

(SNB 2007) Swiss National Bank (SNB). 2007. “Swiss National Bank Provides US Dollar Funding.” December 12, 2007.

SNB press release on coordinated G10 actions to address pressures in funding markets.

-

(ECB 2021) European Central Bank (ECB). 2021. “History of All ECB Open Market Operations.”

Dataset of open-market operations: rates, dates, volumes, and procedures.

-

(Fed 2007c) Board of Governors of the Federal Reserve System (Fed). 2007c. “Factors Affecting Reserve Balances.” “WSHOTSL”, “WSDEALL”, “WORAL”, “WOFRAL”, “WOFSRBFL”, “WACBS”, “RESPPALTNWW”, “H0RESPPALDDNWW”, “WLCFLPCL”, “WLCFLSCL”, “WLCFLSECL”, “WAML1L”, “WAML2L”, “WAML3L”, “H0RESPPALDFNWW”, “WACPFFL”, “H0RESPPALDGNWW”, “WSHOMCB”, “WSHOFDSL”, “WLCFTALFL.” Federal Reserve Economic Data (FRED).

Data disaggregating Federal Reserve credit into its sub-programs.

-

(Fed 2007–2010a) Board of Governors of the Federal Reserve System (Fed). 2007–2010a. Transaction data.

Data describing each loan made by the TAF.

-

(Fed and Runkel 2007–2010b) Board of Governors of the Federal Reserve System (Fed) and Corey Runkel. 2007–2010b.

Dataset scraped from the Fed’s website by Corey Runkel showing the results of all TAF auctions.

-

(Fed 2007–2010c) Board of Governors of the Federal Reserve System (Fed). 2007–2010c. Transaction data.

Data describing each swap the Fed conducted.

-

(Government Accountability Office 2011) Government Accountability Office. 2011. “Federal Reserve System: Opportunities Exist to Strengthen Policies and Processes for Managing Emergency Assistance.” Report to Congressional Addressees GAO-11-696. Washington, D.C.

Government Accountability Office report with statistics on TAF usage.

-

(Krieger 2007) Krieger, Sandra. 2007. “Staff Proposals for Auction Credit Facility and Swap Arrangements.” Briefing presented at the Joint Meeting of the Federal Open Market Committee and Board of Governors of the Federal Reserve System, Washington, D.C., September 18.

Documents drafting the TAF’s parameters before a proposal to the FOMC and Board.

-

(Acharya, Afonso, and Kovner 2013) Acharya, Viral V, Gara Afonso, and Anna Kovner. 2013. “How Do Global Banks Scramble for Liquidity? Evidence from the Asset-Backed Commercial Paper Freeze of 2007.” Staff Report. New York: Federal Reserve Bank of New York.

Paper discussing how banks moved money between jurisdictions during the GFC.

-

(Armantier et al. 2015) Armantier, Olivier, Eric Ghysels, Asani Sarkar, and Jeffrey Shrader. 2015. “Discount Window Stigma during the 2007–2008 Financial Crisis.” Federal Reserve Bank of New York Staff Reports 483.

FRBNY staff research estimating the extent and size of discount-window stigma.

-

(Armantier, Lee, and Sarkar 2015) Armantier, Olivier, Helene Lee, and Asani Sarkar. 2015. “History of Discount Window Stigma.” Liberty Street Economics (blog).

Blogpost examining the history of discount-window stigma.

-

(Bernanke 2015) Bernanke, Ben. 2015. The Courage to Act: A Memoir of the Crisis and Its Aftermath. New York: W.W. Norton.

Account by the Fed Chair describing the GFC and providing context about the relationship between the TAF and swap lines.

-

(Borio and Nelson 2008) Borio, Claudio, and William Nelson. 2008. “Monetary Operations and the Financial Turmoil.” BIS Quarterly Review, International banking and financial market developments, no. March: 31–46.

Study comparing the central bank responses of Australia, Canada, the Eurozone, Japan, Switzerland, and the United States to the Global Financial Crisis.

-

(Carlson, Duygan-Bump, and Nelson 2015) Carlson, Mark A., Burcu Duygan-Bump, and William R. Nelson. 2015. “Why Do We Need Both Liquidity Regulations and a Lender of Last Resort? A Perspective from Federal Reserve Lending during the 2007-09 US Financial Crisis.”

Paper analyzing counterparty risk and the Fed’s measures to contain it.

-

(Christensen, Lopez, and Rudebusch 2009) Christensen, Jens H.E., Jose A. Lopez, and Glenn D. Rudebusch. 2009. “Do Central Bank Liquidity Facilities Affect Interbank Lending Rates?” Working Paper 2009–13. Federal Reserve Bank of San Francisco.

Review estimating the effect of the TAF on lending rates.

-

(Fender and McGuire 2010) Fender, Ingo, and Patrick McGuire. 2010. “European Banks’ US Dollar Funding Pressures.” BIS Quarterly Review, June, 57–64.

Article describing the woes of European banks and how money flowed between US and European branches.

-

(Fulmer 2022) Fulmer, Sean. 2022. “United Kingdom: Discount Window Facility.” Journal of Financial Crises 4, no. 2.

YPFS case study on the Bank of England’s creation of the Discount Window Facility during the Global Financial Crisis.

-

(Gilbert et al. 2012) Gilbert, R Alton, Kevin L Kliesen, Andrew P Meyer, and David C Wheelock. 2012. “Federal Reserve Lending to Troubled Banks During the Financial Crisis, 2007-2010.” Federal Reserve Bank of St. Louis Review 94, no. 3: 221–42.

Review and evaluation of all Fed lending, including the TAF.

-

(Leonard 2022) Leonard, Natalie. 2022. “United States: Federal Home Loan Bank Advances, 2007–2009.” Journal of Financial Crises 4, no. 2.

(Leonard 2022) Leonard, Natalie. 2022. “United States: Federal Home Loan Bank Advances, 2007–2009.” Journal of Financial Crises 4, no. 2.

-

(McAndrews, Sarkar, and Wang 2017) McAndrews, James, Asani Sarkar, and Zhenyu Wang. 2017. “The Effect of the Term Auction Facility on the London Interbank Offered Rate.” Journal of Banking & Finance 83, October: 135–52.

Study estimating the effect of the TAF on the absolute level of the LIBOR-OIS spread.

-

(Omarova 2011) Omarova, Saule T. 2011. “From Gramm-Leach-Bliley to Dodd-Frank: The Unfulfilled Promise of Section 23A of the Federal Reserve Act Adaptation and Resiliency in Legal Systems.” North Carolina Law Review 89, no. 5: 1683–1776.

Law review article examining the use of 23A waivers as a way to funnel money from commercial banks to investment bank affiliates.

-

(Runkel 2022) Runkel, Corey N. 2022. “European Central Bank: Term Refinancing Operations.” Journal of Financial Crises 4, no. 2.

YPFS case describing the Eurozone’s LTROs, SLTROs, and STROs during the GFC.

-

(Taylor and Williams 2009) Taylor, John B., and John C. Williams. 2009. “A Black Swan in the Money Market.” American Economic Journal: Macroeconomics 1, no. 1: 58–83.

Early review of the GFC and the TAF’s attempts to quell market stress.

-

(Wiggins and Metrick 2020) Wiggins, Rosalind, and Andrew Metrick. 2020. “The Federal Reserve’s Financial Crisis Response C: Providing U.S. Dollars to Foreign Central Banks.” Journal of Financial Crises 2, no. 2: 94–115.

YPFS case study reviewing the Fed’s swap lines.

Federal Reserve Haircut Schedule

Source: Federal Reserve System 2006.

Source: Federal Reserve System 2006.

Taxonomy

Intervention Categories:

- Broad-Based Emergency Liquidity

Countries and Regions:

- United States

Crises:

- Global Financial Crisis