Broad-Based Capital Injections

Russian Bank Capital Support Program

Purpose

To provide capital to systemically important banks affected by declining oil prices and international sanctions, as well as increase lending to select sectors of the real economy.

Key Terms

-

Announcement DateDecember 2014

-

Operational DateApril 27, 2015

-

Wind-down DatesNot applicable

-

Legal AuthorityAuthorized by Law No. 451-FZ

-

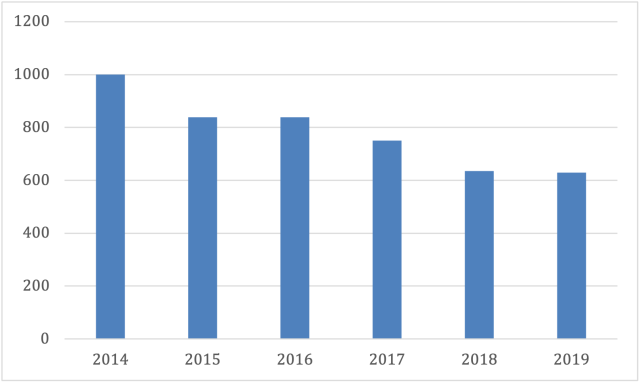

Program SizeInitially one trillion rubles but revised downwards to 838 billion rubles

-

Usage34 banks received a total of RUB 838 billion in OFZs

-

OutcomesRUB 628.6 billion of preferred shares and subordinated debt remain outstanding with the government as of the end of 2020; four banks merged and two lost their banking licenses

-

Notable FeaturesCapital injection exchanged for preferred shares in some cases; maturity for subordinated debt 10-20 years and in some cases could be greater than 50 years

Key Design Decisions

Part of a Package

Communication

Governance

Administration

Program Size

Source of Injections

Eligible Institutions

Individual Participation Limits

Capital Characteristics

Restructuring Plan

Fate of Existing Board and Management

Other Conditions

Exit Strategy

Amendments to Relevant Regulation

Key Program Documents

Taxonomy

Intervention Categories:

- Broad-Based Capital Injections

Countries and Regions:

- Russia