Reserve Requirements

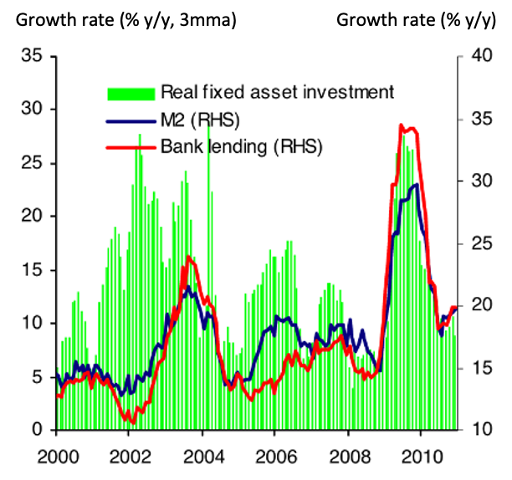

China: Reserve Requirements, GFC

Purpose

To “ensure liquidity supply and beef up the financial strength of financial institutions in lending to priority and weak sectors of the economy” (PBOC 2008h, 8), with a lower rate applied to rural depository institutions “to improve their funding capacity” (PBOC 2008i, 11)

Key Terms

-

Range of RR Ratio (RRR) Peak-to-Trough17.5%–15.5%

-

RRR Increase PeriodJuly 2006–June 7, 2008

-

RRR Decrease PeriodSeptember 16, 2008–December 22, 2008

-

Legal AuthorityLaw of the People’s Republic of China on the People’s Bank of China

-

Interest/Remuneration on ReservesRequired Reserves (local currency): 1.89% (2006–2008); 1.62% (2008–2012) Required Reserves (foreign currency): 0% Excess Reserves: 0.99% (2005–2008); 0.72% (2008–2012)

-

Notable FeaturesTo promote liquidity, the PBOC reduced the RRR more for smaller banks and specific sectors

-

OutcomesRMB 800 billion (USD 117 billion) released in 2008

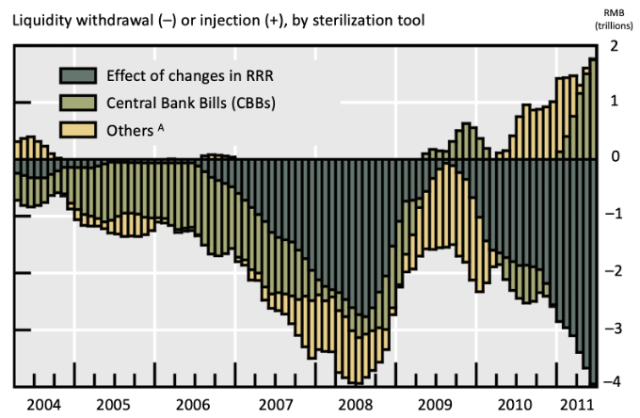

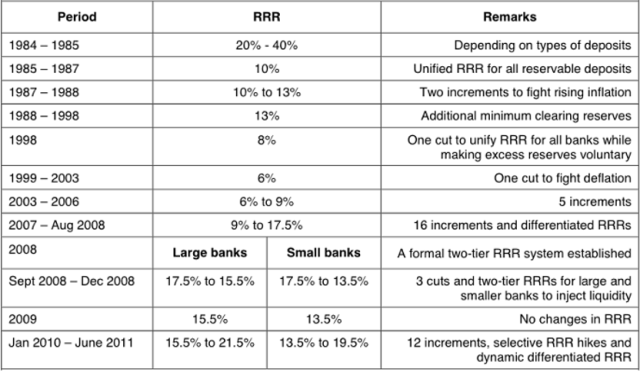

In 2008, China experienced several natural disasters that slowed economic growth, and fearing contagion from the Global Financial Crisis (GFC), the central bank cut the reserve requirement ratio (RRR) three times for large financial institutions, to 15.5%, and four times for small and medium-size financial institutions, to 13.5%. This monetary easing, combined with a USD 586 billion fiscal stimulus package, caused explosive credit growth in China. One year after these RRR cuts, the central bank hiked the ratio 12 times, to a historically high 21.5% for large banks in June 2011; however, it maintained a different ratio for rural credit cooperatives that averaged 300 basis points lower than the RRR for large banks. The People’s Bank of China (PBOC) adjusted the reserve requirement ratio 35 times between July 2006 and June 2011. Throughout this cycle, the central bank’s approach to required reserves policy evolved from a relatively simple regime that applied one ratio to all financial institutions into a complex regime that applied different ratios to individual firms based on size, location, and financial and macroprudential criteria. The central bank increasingly favored the RRR as a cost-effective monetary policy and crisis management tool over which it had greater autonomy than its two other major policy tools: interest rate management and central bank bill issuance. The PBOC said the RRR cuts released USD 117 billion of liquidity into the system.

In 2008, China experienced several natural disasters that slowed economic growth, and, fearing contagion from the Global Financial Crisis (GFC), the central bank cut the reserve requirement ratio (RRR) three times for large financial institutions, to 15.5%, and four times for small and medium-size financial institutions, to 13.5%.

Beginning in 2006, the People’s Bank of China (PBOC) used required reserves to manage liquidity in the financial system, sterilize foreign-exchange intervention,FThe PBOC heavily intervened in international currency markets to maintain targeted exchange rates for China’s currency—the renminbi (RMB), which as of 2010 was denominated in units of yuan (CNY for Mainland China use, or CNH for offshore use)—against a basket of major currencies, mainly USD (Morrison 2009). manage credit allocation, and implement macroprudential policy (Klingelhöfer and Sun n.d.). Between June 2006 and July 2011, the PBOC changed the RRR 35 times. One explanation for the relatively frequent changes—the PBOC ranked among the world’s most frequent adjusters of RRR—was the increasing role of the RRR as an alternative and complement to the PBOC’s other monetary policy tools.

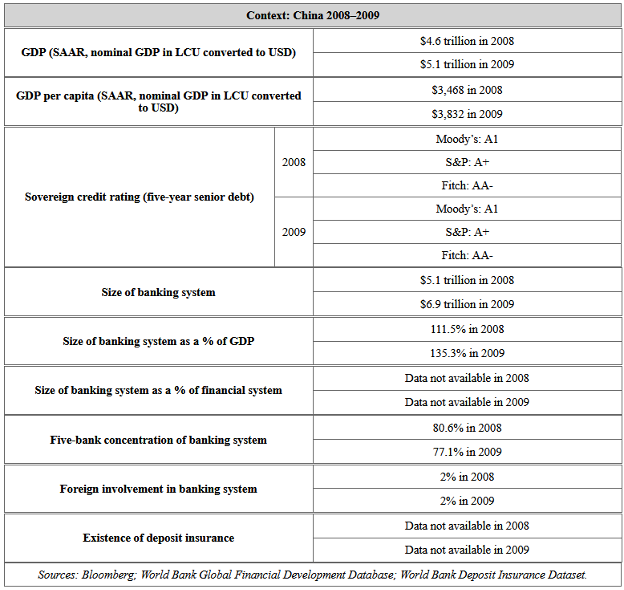

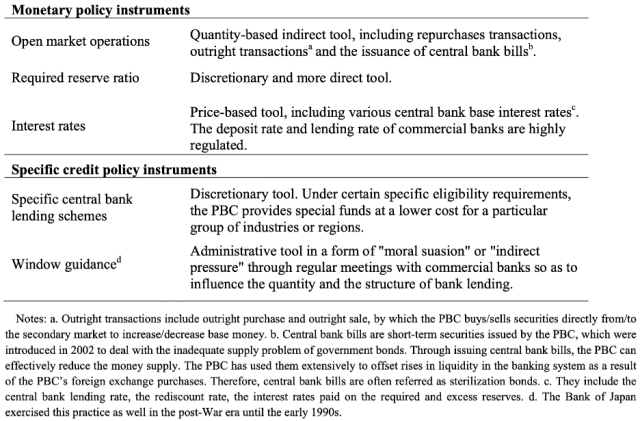

Besides the RRR, the PBOC managed liquidity through open market operations, including transactions with government deposits, repurchase agreements (repos), and the issuance of new, longer-dated central bank bills (CBBs),FThe PBOC initially used treasury bonds or securities as sterilization tools, but in September 2002 it replaced all outstanding securities with CBBs for use in open market operations (Ouyang, Rajan, and Willett 2010). a typically short-term debt instrument designed to absorb liquidity (Wang and Hu 2011). The PBOC came to rely on reserve requirement policy because of its efficacy in the face of large foreign reserve accumulation, its practical benefits to the PBOC, and its integration into a monetary policy framework that targeted quantities amid sometimes conflicting policy objectives (Ma, Xiandong, and Xi 2013).

In the midst of the GFC, China was accumulating large amounts of foreign currency reserves (USD 2.2 trillion) from current account surpluses and foreign direct investment (Li, Willett, and Zhang 2012; Wang and Hu 2011). The PBOC issued local currency or sold domestic bondsFHowever, the PBOC’s stock of government bonds was historically quite low, and the PBOC had little control over issuance (Wang and Hu 2011; Wu 2007). to finance the purchase of foreign currency revenue from exporters (via commercial banks), but it needed to sterilizeFSterilization occurred when the increase in the rate of purchases exceeded the rate of growth of the local money supply. The PBOC’s foreign-exchange interventions (and thus the need for sterilization) depended on China’s external surpluses, its exchange rate management, and capital controls. these purchases to prevent an increase in the local money supply (Wang and Hu 2011; Wu 2007).

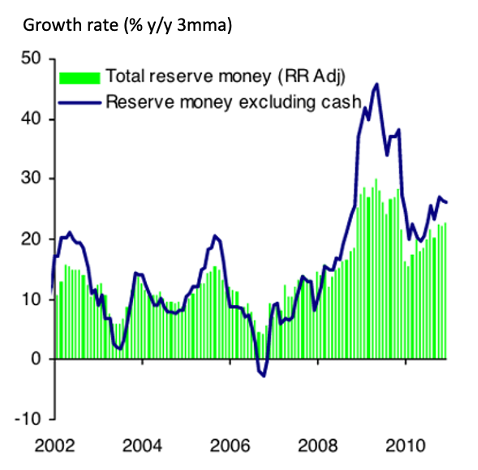

The PBOC preferred adjusting the RRR to issuing CBBs for several reasons. First, it was cheaper, because the central bank typically paid a higher rate on CBBs than the rate at which it remunerated required reserves (Sun 2013; Wang and Hu 2011). Second, a reserve requirement ratio hike “froze”FBy late 2011, a 50-basis-point (bp) increase in reserve requirements was estimated to “freeze” USD 51.3 billion in financial system assets (Miao 2015). funds more permanently than CBBs, tightening monetary conditions and controlling inflationary pressure until the PBOC lowered the ratio again (PBOC 2011a; Wang and Hu 2011). Third, RRR adjustments needed the approval of China’s State Council, the highest government body, but it may have been easier to gain approval for these adjustments than, for example, interest rate decisions, which required the agreement of many other agencies (Wang and Hu 2011). Fourth, the PBOC believed that RRR adjustments would affect liquidity within the banking sector only—not the funding cost to borrowers—and thus it was easier to reach consensus among policymakers (Ma, Xiandong, and Xi 2013). For all these reasons, the RRR effectively replaced CBBs as a liquidity fine-tuning mechanism after 2006 (see Figure 1).

Figure 1: Sterilization Tools in China

Note: Chart displays components of net domestic assets; data are year-on-year changes in the three-month moving average; positive (negative) data indicate injection (withdrawal) of liquidity. China pursued monetary expansion in 2009, then resumed sterilization in 2010 (Wang and Hu 2011).

Source: Ma, Xiandong, and Xi 2013.

Leading up to the Global Financial Crisis (GFC), China ran current account and capital account surpluses; GDP grew 13% in 2007 (Ma, Xiandong, and Xi 2013; PBOC 2008i). The PBOC began hiking reserve requirements in 2006 in order to sterilize increasing foreign-exchange interventions, curb credit growth, and tighten monetary conditions (Wong 2011). Between 2006 and 2008, the PBOC hiked the reserve requirement ratio (RRR) 19 times, from 8.5% to 17.0%. In 2007, China virtually froze new lending through “window guidance,” essentially telling banks to stop lending; in 2008 and again in 2010, China imposed quarterly and monthly lending quotas (Wang and Hu 2011).

But in 2008, China experienced a series of natural disasters that depressed economic growth,FIn January 2008, China faced its worst winter storm in half a century, and by February the central government requested that financial institutions increase credit to small banks and rural credit cooperatives in severely affected regions. On May 12, 2008, an earthquake struck Wenchuan, causing a deep recession in that area and decreasing the region’s growth by 37% (Morrison 2009; PBOC 2008i). The PBOC responded by guiding bank lending to disaster-stricken areas, suspending credit quotas (PBOC 2008i). and the central government and PBOC were concerned about the potential for disruptions in global financial markets to spread to China. Some Chinese financial institutions became distressed, but due to the small presence of foreign banks in China and the country’s strong capital controls, the financial system was largely insulatedFAdditionally, partly due to restrictions on Chinese residents investing overseas, Chinese investors and firms had limited exposure to troubled US mortgage-linked assets, and capital flight was a very low risk (Morrison 2009; Li, Willett, and Zhang 2012). Foreign-funded banks accounted for only USD 193 billion, or 2.4% of total banking assets, in March 2008 (Li, Willett, and Zhang 2012). from global contagion, with losses limited to 2% of pre-crisis GDP between 2007 and 2009 (Li, Willett, and Zhang 2012; Morrison 2009; PBOC 2009a; Wu 2007). The more significant impact was the decreased demand from trade partners who were directly affected by the GFC, which negatively impacted China’s export sector, making up one-third of its pre-crisis GDP (Wong 2011). Meanwhile, commodity markets, after surging in the first half of the year, crashed in August 2008, contributing to the decline in China’s export growth rate from 20% in October to -2.2% in November (Li, Willett, and Zhang 2012; Zhang n.d.).

The government took several measures to ease financial and economic conditions. The PBOC reversed nearly two years of RRR hikes and, for the first time, it began to differentiate RRR policy based on institution size, cutting the RRR from 17.0% to 15.5% for large banks and 13.5% for small and rural financial institutions in the fourth quarter of 2008. The PBOC also loosened monetary policy by eliminating credit quotas, guiding credit toward agricultural sectors, and cutting the benchmarkFIn China, the benchmark rates are lower bounds on interest rates that commercial banks are allowed to charge to their clients and tend to be a lower-bound constraint for commercial banks (Cong et al. 2018). deposit and lending rates over this period. (Cong et al. 2018; PBOC 2008d; PBOC 2008i; Wong 2011). The central government responded to the crisis on November 9, 2008 with an economic stimulus package totaling USD 586 billion,FPer Yahoo Finance, USD 1 = CNY 6.817 (onshore) as of November 10, 2008. or 12.5% of GDP (PBOC 2008i; Wong 2011).

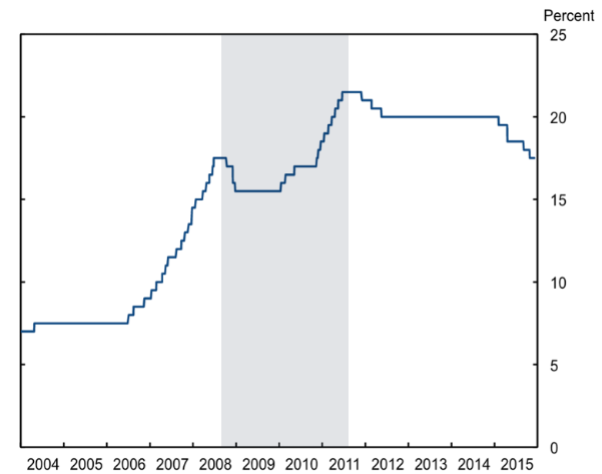

The PBOC continued operating the new two-tiered required reserves regime from September 2008 through early 2011 (see Figure 2). Leading up to the GFC and throughout China’s response to it, the PBOC’s required reserves policy evolved from a relatively simple system of one ratio applied to all Chinese financial institutions into a complex regime that applied different ratios to individual firms based on their size, customer base, and location, as well as macroprudential factors such as the firm’s capital adequacy and liquidity ratios (Ma, Xiandong, and Xi 2013).FIndeed, since the liberalization of its banking sector in 1998, China’s financial regulation and monetary policy (including its required reserves policy) was applied across the financial system relatively equally, but over time each policy tool became increasingly complex and differentiated.

Figure 2: Reserve Requirement Ratio Changes by Institution Type, 2004–2013

Source: Fungáčová, Nuutilaine, and Weill 2015.

Source: Fungáčová, Nuutilaine, and Weill 2015.

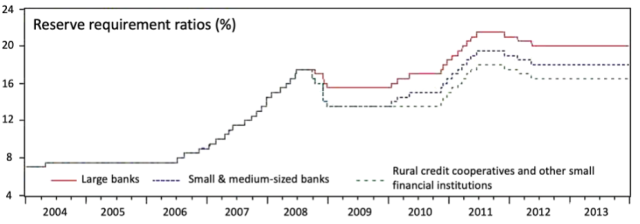

The PBOC’s monetary easing combined with the central government’s stimulus measures grew net new credit by USD 616 billion in 2008, surpassing both the prior year’s growth and the State Council’s 2008 target of USD 586 billion.FIn 2008, the State Council targeted an increase in new bank lending of USD 586 billion (CNY 4 trillion) and growth of the broad money supply by 17%. For more information on the stimulus measures and quantitative targets, see Key Design Decision No. 2, Part of a Package. The PBOC’s loose monetary policy continued through 2009, and so did the surge in bank lending, which totaled USD 1.4 trillionFMuch of this credit was extended to state-sponsored infrastracture projects (Fungáčová, Nuutilaine, and Weill 2015; Wong 2011). that year, or nearly 30% of GDP (see Figure 3) (Fungáčová, Nuutilaine, and Weill 2015; Wong 2011).

Figure 3: Bank Credit, Broad Money (M2), & Fixed Asset Investment Growth

Source: Wang and Hu 2011.

Source: Wang and Hu 2011.

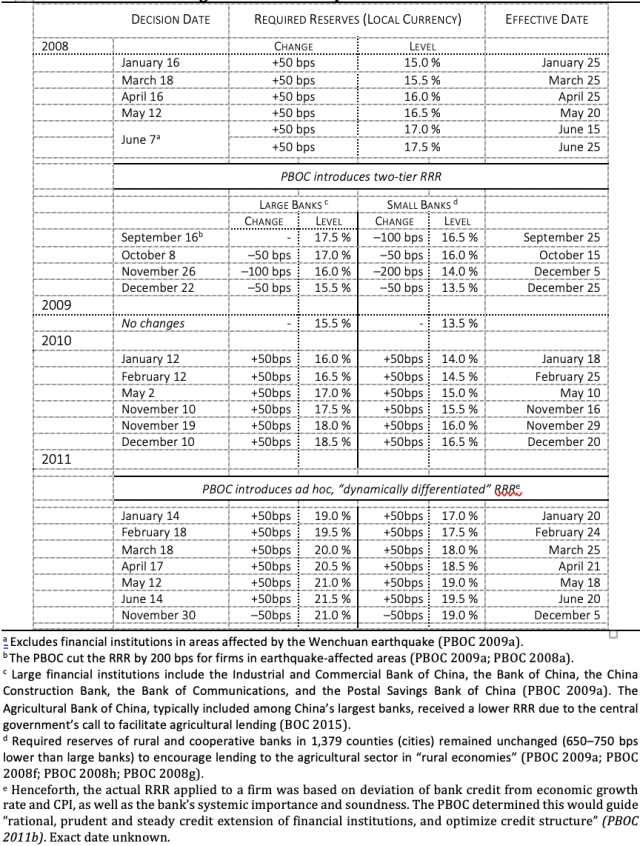

The Chinese economy experienced explosive credit growth throughout 2009—along with increases in the base money supply (see Figure 4) and GDP, leading the PBOC to return to a tight monetary policy stance. The central bank raised the RRR three times in the first half of 2010, from 15.5% back to a pre-crisis level of 17.0% for large banks and from 13.5% to 15.0% for small and medium-size banks (PBOC 2010b; PBOC 2010c). In order to support rural communities and the agricultural sector, the PBOC did not alter the RRR for small and rural financial institutions. By late 2010, the PBOC observed excess liquidity in global markets washing into the Chinese financial system, and it used required reserves to drain this excess liquidity, repeatedly hiking the RRR until the headline ratio for large banks peaked at 21.5% on June 14, 2011 (PBOC 2010b; PBOC 2010c; PBOC 2010d). Between July 2006 and June 2011, the PBOC changed the RRR 35 times, averaging a change every two months (usually 50 bps each time), for a net increase from 8.5% to 21.5% for large banks (see Figure 5) (Ma, Xiandong, and Xi 2013).

Figure 4: Base Money Growth

Source: Wang and Hu 2011.

Source: Wang and Hu 2011.

Figure 5: China’s Reserve Requirement Ratio for Large Financial Institutions

Source: Chang et al. 2017.

The PBOC said the RRR cuts released USD 117 billion of liquidity into the system (PBOC 2008i). Meanwhile, the higher RRR reduced the Chinese monetary multiplier from its peak of 5.2 times in May 2006, when a series of reserve requirement adjustments started, to 3.8 times in December 2008, when it ended.

Fungáčová, Nuutilaine, and Weill (2015) find that the RRR was an effective policy instrument, because China’s banks could not easily substitute away from deposits as a funding source, and firms could not easily substitute away from bank credit. They also find that changes in reserve requirements influenced loan growth directly, although this effect varied across bank type, and the bank lending channel did not play a major role in the transmission of monetary policy in China (Fungáčová, Nuutilaine, and Weill 2015).

Yang (2008) suggested that the design of the Chinese financial system constrained the effectiveness of required reserves, noting that renminbi exchange rate flotation and interest rate marketization were necessary for required reserves adjustments to be more effective (Pan et al. 2012). Pan et al. (2012) found that the PBOC’s frequent changes to the RRR had no effect on excess liquidity, controlling the money supply, or preventing inflation.

The PBOC frequently reported on the efficacy of its RRR adjustments. After the late-2008 RRR cuts, the PBOC claimed liquidity supply in the banking system was sufficient. For example, after two hikes to the RRR in early 2010, the PBOC stated that a higher RRR helped sterilize part of the excess liquidity in the banking system, yet left sufficient liquidity in the market to support “proper money and credit growth and economic development” (PBOC 2010b).

Ma, Xiandong, and Xi (2013) note that the PBOC applied different reserve requirements to individual firms for many reasons, often in combination with price-based policy tools, such as interest rates, and quantity-based tools, such as “window guidance” policy (see Figure 10 for a summary of the PBOC’s policy tools). Thus, it is difficult to isolate the effects of RRR adjustments from other policy actions. For example, a reserve requirement ratio hike did not necessarily imply the PBOC was taking a tighter policy stance; it depended on the magnitude of sterilization and other policy actions by the PBOC and central government. Any contractionary effects of RRR hikes were shaped by interactions among these policy tools. Moreover, Ma et al. find that the channels for RRR adjustments to influence China’s monetary conditions are not well understood and remain controversial, which is reflected in the varying results of empirical research on the China’s required reserves policy (Ma, Xiandong, and Xi 2013).

Key Design Decisions

Purpose

1

Although the PBOC has had reserve requirements since 1984, it only began regularly using them as a policy tool in 2007 (Ma, Xiandong, and Xi 2013). In its second-quarter 2006 Monetary Policy Report, the PBOC explained that reserve requirements were initially used to ensure commercial banks had sufficient liquidity to cover unexpected payments, but over time had become a tool for the PBOC to manage banking sector liquidity (PBOC 2006b).

Between 2006 and early 2008, the PBOC hiked the RRR several times to support its tight monetary policy and sterilize its foreign-exchange interventions.FLeading up to the GFC, the PBOC used required reserves to sterilize an estimated 70% of foreign-exchange inflows (PBOC 2008i; Wang and Hu 2011). The PBOC combined RRR hikes with open market operations to absorb extra liquidity in the banking system and restrain bank lending (PBOC 2008f). In a 2007 speech, Deputy Governor Wu explained that raising reserve requirements was preferable to CBB issuance when the PBOC wanted to reduce liquidity while maintaining market interest rates (Wu 2007).

When the GFC threatened China, the PBOC cut the RRR to ensure a healthy supply of liquidity and reinforce financial institutions as the PBOC guided lending to priority and weak sectors of the economy (PBOC 2008h). The PBOC claimed these RRR cuts released USD 117 billion of liquidity into the system (PBOC 2008i). When initiating this RRR easing cycle, the PBOC adopted a formal two-tier reserve requirement system that applied a reserve requirement ratio to the largest commercial banks that averaged 200 bps above the rate applied to smaller commercial banks and 600–800 bps above urban and rural credit cooperatives (Ma, Xiandong, and Xi 2013). Ma et al. note that the purpose of the two-tier requirement was to ease liquidity pressures on small banks during the GFC, while increasing the costs of RRRs for larger banks.

The PBOC hiked the RRR three times in early 2010 without adjusting benchmark interest rates. Later that year, the PBOC switched to an overall tight monetary policy, supported by many hikes to the RRR that continued into 2011. The PBOC used the adjustment of the differentiated deposit reserve requirement ratio to support the role of conventional monetary policy instruments. This policy stance continued through 2010, and the PBOC reiterated that the use of required reserves in combination with open market operations allowed the PBOC to manage liquidity, facilitate efforts to normalize money and credit growth, and handle inflationary expectations (PBOC 2010d).

Part of a Package

1

China regularly combined RRR with open market operations and other monetary policy tools (Fungáčová, Nuutilaine, and Weill 2015; Ma, Xiandong, and Xi 2013).

The PBOC took several measures to promote liquidity during the GFC. In October 2008, the PBOC established a term auction facility for financial institutions in need of short-term liquidity (PBOC 2009b; PBOC 2010e). In November 2008, the government announced a two-part response to the international financial crisis. First, the central government approved an economic stimulus package totaling USD 586 billion, or 12.5% of GDP, which would be spent over two years on infrastructure projects and social welfare policies. Second, the central government sought to expand credit supply to the real economy by ordering the PBOC to cut reserve requirements from 17% to 15.5% (or 13.5% at small and rural banks), lower benchmark lending rates, and eliminate credit quotas (Cong et al. 2018; PBOC 2008i; Wong 2011). The State Council also called for banks to facilitate consumer credit and support car purchases and mortgages for first-time buyers, even establishing a quantitative target for new lending of USD 586 billion in 2008 and 17% growth in the money supply (Wong 2011).

In December 2008, the State Council announced a partial liberalization of the financial system, injected USD 14.6 billion into China’s policy banks and USD 17.6 billion into investment funds, and urged commercial banks to lend to solvent firms and those in distaster-sticken areas (PBOC 2008i; Wong 2011). The State Council also announced new credit mechanisms for small to medium-size enterprises (SMEs), broader eligibility for corporate bond issuance, and new regulations expanding the range of real estate investment trust funds (REITs) and private equity (PE) funds (Wong 2011).

Because the State Council directed many of the PBOC’s activities, the PBOC was expected to align its monetary policy with the government’s stimulus measures.FIn announcing its monetary easing in 2008, the PBOC called for its staff to “further integrate their thinking and action with the central government’s judgment on [the] economic situation and its policy responses” (PBOC 2008d).

Legal Authority

1

The Law of the People’s Republic of China on the PBOC (PBOC’s enabling law) permits the central bank to require financial institutions to place deposits with the central bank at a prescribed ratio (Tenth NPC 2003b, ch. 4, article 23(1)).

Article 32 of the PBOC law empowers the PBOC to govern the rules and regulations on reserves (Tenth NPC 2003b Article 32(1)). The PBOC needed State Council approval before adjusting bank deposit and lending rates, but the PBOC may have had greater control over changes in the RRR (Fungáčová, Nuutilaine, and Weill 2015; Ma, Xiandong, and Xi 2013).

The PBOC may redefine the reservable deposit base to include different types of deposits in order to adjust the effective reserve requirements without altering headline RRR (Ma, Xiandong, and Xi 2013).

Commercial banks are bound by the Chinese Commercial Bank Law, which stipulates that banks must place deposits with the PBOC and maintain sufficient provision for payment in accordance with the PBOC’s regulationsFChapter VIII, Article 77(3) of the Commercial Bank Law identifies the penalties for noncompliant commercial banks. (Tenth NPC 2003a, ch. III, article 32).

The PBOC Law states that the goal of China’s monetary policy is to maintain currency stability and facilitate economic growth (Gang 2019; Tenth NPC 2003b, ch. 1, article 3). In practice, this meant that PBOC policy was also directed toward other policy goals, such as providing affordable financing to economic sectors or geographical areas (Fungáčová, Nuutilaine, and Weill 2015).

Administration

1

The PBOC administered all changes to the RRR.

Since August 2007, the PBOC had required commercial banks to deposit reserves in the form of foreign exchange, which were considered external assets on the PBOC’s balance sheet because they were managed by the State Administration of Foreign Exchange (SAFE), which is part of, but distinct from, the PBOC (Setser and Pandey n.d., 4).

Governance

1

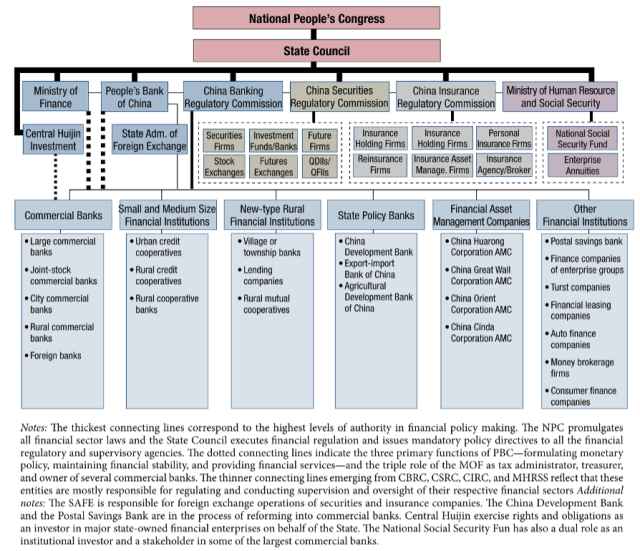

Article 7 of the PBOC Law states that the PBOC forms monetary policy under the leadership of the State Council, the highest government body in China,FHowever, the highest decision-making body in the country is the Standing Committee of the Politburo (Elliott and Yan 2013). See Figure 8 for a hierarchy of the Chinese financial system. and independent from the influence of other government offices or individuals (Tenth NPC 2003b). The State Council determined the functions, responsibilities, composition, and procedures of the PBOC’s Monetary Policy Committee (Tenth NPC 2003b, ch. 2, article 12).

According to Article 5 of the PBOC Law, the central bank submitted all decisions related to China’s money supply, interest rates, and exchange rates, among other issues, to the State Council (Tenth NPC 2003b). In practice, many regulatory and financial sector agencies were involved in setting the exchange rate and interest rate limits, but the State Council had the ultimate decision (Elliott and Yan 2013; Wang and Hu 2011).

The law required the PBOC to submit work reports to the Standing Committee of the NPC on the conduct of monetary policy and the operations of the financial sector, and record its monetary policy decisions and procedures for the State Council (Tenth NPC 2003b, ch. 1, articles 5-6; ch. 2, article 12).

Communication

1

The PBOC announced RRR adjustments in press releases, and they typically became effective one week after announcement. In its 2009 Annual Report, the PBOC cited a requirement by the State Council to increase publicity and education around its crisis response and measures to grow the Chinese economy (PBOC 2010a).

In explaining its cuts to the RRR and benchmark interest rates, the PBOC claimed it was signaling that it would secure economic growth and stabilize market expectations (PBOC 2008h). Throughout the crisis, the PBOC characterized RRR adjustments as a supplement to “conventional” monetary policy instruments (flexible open market operations) to manage liquidity, facilitate efforts to normalize money and credit growth, and manage inflationary expectations (PBOC 2010d).

Throughout the response to the GFC, the PBOC’s communications cited State Council communications and decisions made at Central Economic Work Conferences, annual meetings that determined China’s economic agenda and banking and regulation priorities.

Assets Qualifying as Reserves

1

The PBOC ordered banks to hold all required reserves as deposits at the PBOC; they could use those reserves for intraday settlements. (Ma, Xiandong, and Xi 2013).

Reservable Liabilities

1

Shortly after its introduction in 1984, the PBOC’s RRR regime differentiated by deposit type, including corporate deposits, savings deposits, or demand deposits. During the GFC, the PBOC’s reserve requirement covered most deposits, but the PBOC did not specify these deposit types and likely differentiated the RRR based on financial institution type only (Ma, Xiandong, and Xi 2013).FMa et al. note that the reservable deposit base was expanded in September 2011 to include some margin deposits; this expansion effectively hiked the RRR by 125 bps (Ma, Xiandong, and Xi 2013).

Computation

1

Since the PBOC began adjusting the RRR more regularly in 2007, the PBOC used a “time-point” assessment. Chinese banks generally relied on deposit funding. Thus, given the low remuneration rate on required reserves, a high RRR imposed a large opportunity costFBecause a policy rate hike, intended to be contractionary, might have attracted foreign-capital inflows and offset the monetary tightening, an increase in unremunerated (or partially remunerated) reserves effectively “taxed” banks by raising the lender’s cost of capital and the cost of credit in the economy, and may have widened the loan deposit rate spread (within the state-mandated deposit rate cap) (Ma, Xiandong, and Xi 2013). on banks. Under the time-point framework, banks had to meet the RRR on a daily basis (based on a 10-day rolling average of the stock of deposits) and therefore tended to hold excess reserves as a buffer, averaging 1.5% of deposits in 2011 (Ma, Xiandong, and Xi 2013; Turner, Tan, and Sadeghian 2012).

Chinese banks generally relied on deposit funding (Turner, Tan, and Sadeghian 2012). Thus, given the low remuneration rate on required reserves, a high RRR imposed a large opportunity costFBecause a policy rate hike, intended to be contractionary, might have attracted foreign capital inflows and offset the monetary tightening, an increase in unremunerated (or partially remunerated) reserves effectively “taxed” banks by raising the lender’s cost of capital and the cost of credit in the economy, and may have widened the loan deposit rate spread (within the state-mandated deposit rate cap) (Ma, Xiandong, and Xi 2013). on banks. Banks had to meet the RRR on a daily basis (based on a 10-day rolling average of the stock of deposits) and therefore tended to hold excess reserves as a buffer, averaging 1.5% of deposits in 2011 (Turner, Tan, and Sadeghian 2012). The IMF stated that this daily requirement of reserves meant the RRR was mainly a tool to manage aggregate liquidity rather than a prudential buffer for banks (IMF 2011).

Eligible Institutions

1

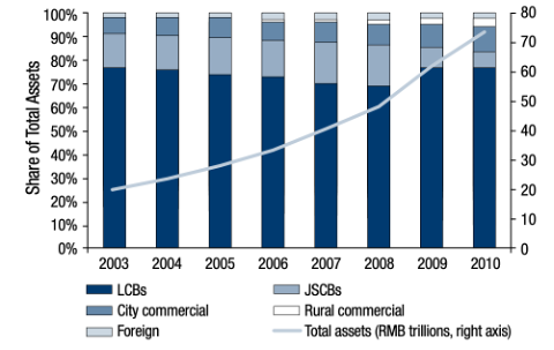

Required reserves generally applied to all Chinese-domiciled financial institutions. The PBOC Law defines financial institutions as Chinese-domiciled policy banks,FThe “policy banks,” which were formerly state-owned, included the Industrial and Commercial Bank of China, the Agricultural Bank of China, the Bank of China, the China Construction Bank, and the Bank of Communications (PBOC 2009a). In 2005, all five banks were converted to joint-stock companies. Together, they accounted for 52% of total banking assets in 2008 (Fungáčová, Nuutilaine, and Weill 2015). commercial banks, urban credit cooperatives, rural credit cooperatives, and other deposit-taking institutions (Tenth NPC 2003b, Ch. 8, Article 52).

The PBOC began to differentiate between small and large financial institutions in July 2006, when it applied a 50 bps RRR hike to all institutions except rural cooperatives (PBOC 2006a). It also applied differentiated RRR based on capital adequacy levels and nonperforming loan ratios (PBOC 2007). Rural cooperative banks and credit cooperatives constituted only 0.02% of deposits in the banking system (see the Appendix for more information on the Chinese financial system) (Lardy 2008).

The PBOC continued to differentiate between small and large financial institutions as it lowered RRRs during the GFC. In the last quarter of 2008, the PBOC cut the RRR for large banks three times, from 17.5% to 15.5%, and cut the RRR for small and medium-size banks four times, from 17.5% to 13.5%.FA standard definition of medium- and small-size commercial banks included 12 joint-equity commercial banks (excluding the major policy banks), urban and rural commercial banks, and urban and rural credit unions (Cong et al. 2018). Rural credit cooperatives, who were the primary originators of agricultural loans to populations adversely affected by natural disasters in 2008, were also subject to the lower RRR (Ma, Xiandong, and Xi 2013).

Timing

1

On September 16, the PBOC’s Monetary Policy Committee met and, under the orders of the central government, cut benchmark interest rates and the RRR for small and medium-size institutions by 100 bps (PBOC 2008a; PBOC 2008h). It cut the RRR for institutions in disaster-stricken areas by 200 bps (PBOC 2008a).

The MPC met three more times in the final quarter of 2008, and cut the RRR for all institutions on each occasion: October 8, October 29, and November 26 (PBOC 2008b; PBOC 2008c; PBOC 2008e). Shortly after its October 29 announcement of RRR cuts, the PBOC announced a moderately loose approach to its monetary policy (PBOC 2008d).

RRR adjustments took effect roughly one week after their announcement, which the PBOC believed gave financial institutions a sufficient amount of time to adjust their reserves (PBOC 2006b).

Changes in Reserve Requirements

1

As the crisis spread to China in the second half of 2008, the PBOC lowered the RRR in three steps to 15.5% for large banks, and in four steps to 13.5% for small banks and rural credit cooperatives (PBOC 2009a). The PBOC maintained this headline RRR level throughout 2009 (see Figure 6; see Figure 11 for an overview of reserve requirement changes between 1984 and 2011).

The PBOC intended these RRR cuts to maintain “stable, sustained, and relatively fast growth of the national economy” (PBOC 2008a). The PBOC stated that the first required reserve regime change in 2008—to differentiate RRR based on the size of financial institutions—was part of a broader principle of “differentiated treatment to different sectors,” including credit allocation to agricultural sectors and preferential treatment to credit institutions in rural areas affected by the natural disasters (PBOC 2008i, 51).

Figure 6: Timeline of Changes to Reserve Requirements of Financial Institutions

Sources: Miao 2015; PBOC 2008f; PBOC 2009a.

Deposit/Savings/Term Rates

It does not appear that the PBOC differentiated the RRR based on liability type during the period covered by this case study. However, the PBOC was able to redefine the reservable deposit base to alter effective reserve requirements without changing the headline RRR. When it launched its reserve requirement system in 1984, the PBOC briefly differentiated reserve requirements by type of deposit (ranging from 20% to 40%), but this practice ended in 1985 (Ma, Xiandong, and Xi 2013).

Local/Foreign Currency Rates

The PBOC’s headline RRR changes applied to local currency deposits; the rate on foreign currency deposits remained 5% from 2007 to 2021 (Ma, Xiandong, and Xi 2013).FThe rate on foreign currency deposits was 3% in 2005, 4% in 2006, and 5% beginning May 2007, where it remained through the end of the next decade (ChinaDaily 2021; China Knowledge 2021).

Beginning in August 2007, the PBOC required some banks to meet the increases in the RRR by placing foreign currency, rather than local currency, deposits with the central bank, thus reducing the magnitude of central bank intervention required of the PBOC (Lardy 2008; Setser and Pandey n.d.).

Countercyclical Requirement

In 2011, the PBOC adopted a dynamically differentiated reserves regime, allowing for ad hoc RRR adjustments on a firm-by-firm basis. The PBOC used RRR adjustments to tighten monetary conditions as a countercyclical measure, but this was often done in combination with other policy tools, and its effect is difficult to isolate. For example, a reserve requirement ratio hike did not necessarily imply the PBOC was taking a tighter policy stance; it depended on the magnitude of sterilization and other policy actions by the PBOC and central government. Any contractionary effects of RRR hikes were shaped by interactions among the PBOC’s other policy tools (Ma, Xiandong, and Xi 2013). The PBOC’s benchmark interest rate policy, on the other hand, generally followed inflation and did not lead it in a counter-cyclical way (Wang and Hu 2011).

Banks with capital adequacy less than the statutory rate, or nonperforming loan ratio above a certain number, faced a penalty RRR that was 50 bps higher than the applicable RRR (Lardy 2008; PBOC 2008i; PBOC 2007).

Changes in Interest/Remuneration

1

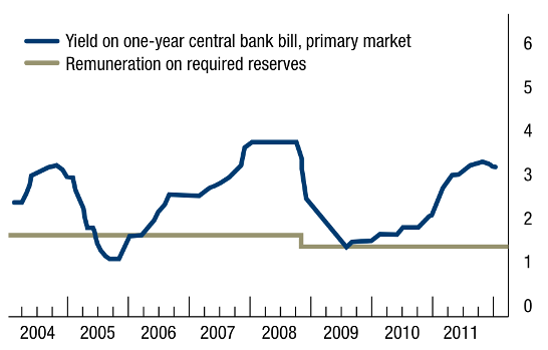

Since it was established in February 2002, the PBOC’s remuneration rate on required local currency deposit reserves remained fixed at 1.89% (Lardy 2008; Ma, Xiandong, and Xi 2013). In late 2008, the PBOC cut the remuneration rate on required reserves of local currency deposits to 1.62% (Ma, Xiandong, and Xi 2013). Excess reserves were remunerated at 0.72% (BOC 2015). By comparison, commercial banks earned an average of 8.72% in March 2008 on loans with terms of six months to one year (Lardy 2008). Thus, the reserve tax burden—the spread between the interest banks receive on central bank reserves and the returns banks could earn on loans—was relatively high in China.

In 2011, the remuneration rate was 1.62% per annum on required reserves, compared to an average auction yield of 2.72% for one-year CBBs (Ma, Xiandong, and Xi 2013; Wang and Hu 2011). The relative “cost” of CBBs was due to the (normally) lower remuneration rate paid on required reserves and the potential for net negative sterilization. In the event that the short-term rate paid on these domestic debt instruments exceeded the average interest rates received on the PBOC’s foreign asset holdings (such as US Treasuries), the PBOC could have realized significant net losses on its foreign-exchange interventions (Wang and Hu 2011). However, these “cost savings” to the PBOC are passed on to banks, who potentially passed them on to their customers (Ma, Xiandong, and Xi 2013).

In 2007, the interest rate paid on CBBs rose by 90 bps for three-month bills, 126 bps for one-year bills, and 155 bps for three-year bills, meaning the implicit tax on required reserves, which were mandatory, was greater than the implicit tax on holding CBBs, which was voluntary (Lardy 2008). According to Ma et al. (2013), the burden that required reserves imposed on banks was estimated at 0.3% of GDP in 2010, which banks appeared to pass on to their depositors (Ma, Xiandong, and Xi 2013).

The PBOC generally remunerated reserves at a below-market rate—lower than the rate paid on CBBs or government bonds (see Figure 7). The remuneration rate on required reserves typically served as a floor to the overnight interbank rate (Ma, Xiandong, and Xi 2013; Wang and Hu 2011).

Foreign currency deposits were not remunerated (Ma, Xiandong, and Xi 2013).

Figure 7: PBOC Bill Yield and Remuneration on Required Reserves (%)

Source: Elliott and Yan 2013.

Source: Elliott and Yan 2013.

Other Restrictions

1

The PBOC did not attach other conditions to its reserve requirement adjustments.

Impact on Monetary Policy Transmission

1

China’s monetary policy consisted of quantity-based tools—including required reserves, as well as “window guidance,” credit quotas, and other administrative measures—and price-based tools, such as benchmark rates (and other policy interest rates) and open market operations (Fungáčová, Nuutilaine, and Weill 2015). PBOC Governor Yi Gang stated that the central bank managed liquidity with open market operations and required reserves and adjusted the money supply with central bank lending and discounts (Gang 2019). Given China’s carefully controlled exchange rate regime and regulated interest rate policy, the PBOC’s monetary policy framework relied more on RRR adjustments than open market operations (Ma, Xiandong, and Xi 2013). Often, the PBOC coordinated benchmark interest rate cuts and decreased CBB issuance with RRR cuts (PBOC 2008h).

Initially, the PBOC could manage liquidity with RRR adjustments without signaling policy rates,FSince 2007, the PBOC had guided the auction yield toward the one-year bank deposit rate and used CBB auctions to signal potential changes to policy rates (Ma, Xiandong, and Xi 2013). Over time, however, RRR adjustments began to signal other interest rate changes, and the RRR was adjusted in line with benchmark interest rates (Fungáčová, Nuutilaine, and Weill 2015). In a 2007 speech, Deputy Governor Wu explained that raising reserve requirements was preferable to CBB issuance when the PBOC wanted to reduce liquidity while maintaining market interest rates (Wu 2007). but over time RRR adjustments began to signal the PBOC’s posture on bank lending and management of the money supply (BOC 2015; Ma, Xiandong, and Xi 2013; Martin 2012).

Duration

1

The PBOC eased the RRR beginning on September 16, 2008 (for small banks) and made its last cut on December 22, 2008 (for all banks). The PBOC did not preannounce an end date for the easing, nor state publicly the criteria under which it would discontinue its easing.

Key Program Documents

-

(Ma, Xiandong, and Xi 2013) Ma, Guonan, Yan Xiandong, and Liu Xi. 2013. “China’s Evolving Reserve Requirements.” Journal of Chinese Economic and Business Studies 11, no. 2: 117–37.

Analysis of China’s reserve requirements and how the PBOC has come to rely on required reserves policy for myriad reasons.

-

(PBOC 2008a) People’s Bank of China (PBOC). 2008a. “PBC Decides to Cut Benchmark Lending Rates and Reserve Requirement Ratio (9/15/08).”

First announcement of differentiated RRR for depository institutions based on size.

-

(PBOC 2008b) People’s Bank of China (PBOC). 2008b. “PBC Decides to Cut Reserve Requirement Ratio and (10/8/08).”

Announcement of 50 bp RRR cut for all depository institutions.

-

(PBOC 2008c) People’s Bank of China (PBOC). 2008c. “PBC Decides to Cut RMB Benchmark Deposit and Loan Rates (10/29/08).”

Announcement of deposit and lending rate cuts in October 2008.

-

(PBOC 2008d) People’s Bank of China (PBOC). 2008d. “PBC to Implement Moderately Loose Policy to Boost Growth.”

Announcement of the PBOC’s loose monetary policy stance in response to the GFC.

-

(PBOC 2008e) People’s Bank of China (PBOC). 2008e. “PBC Decides to Cut Benchmark Deposit and Loan Rates and Reserve Requirement Ratio (11/26/08).”

Announcement of 100 bp RRR cut to large financial institutions and 200 bps cut for small and medium-size financial institutions.

-

(Tenth NPC 2003a) Tenth National People’s Congress (Tenth NPC). 2003a. “Law of the People’s Republic of China on Commercial Banks.”

The primary Chinese law governing commercial banking activity.

-

(Tenth NPC 2003b) Tenth National People’s Congress (Tenth NPC). 2003b. “Law of the Peoples Republic of China on the People’s Bank of China.”

The act establishing the PBOC, as revised by the Committee of the Tenth National People’s Congress at its Sixth Meeting on December 27, 2003.

-

(ChinaDaily 2021) ChinaDaily. 2021. “PBOC Raises Requirement for Banks’ Forex Deposits.” June 1, 2021.

News article on foreign currency reserve requirements including history of the levels mandated by the PBOC.

-

(China Knowledge 2021) China Knowledge. 2021. “China Will Raise Reserve Requirement Ratio for Foreign Currency Deposits to 7%.”

News article covering the PBOC decision to raise required reserves of foreign currency in China for the first time since May 2007.

-

(Gang 2019) Gang, Yi. 2019. “China’s Monetary Policy Framework,” January.

Speech by the governor of the People’s Bank of China, at Chang’an Forum, Tsinghua University, Beijing, December 13, 2018.

-

(PBOC 2006a) People’s Bank of China (PBOC). 2006a. “A PBC Official Answers Questions on Adjustment of Reserve Requirement Ratio.”

Transcript of a press conference on the PBOC’s adjustment of reserve requirements in 2006, when the RRR hiking cycle in China began.

-

(BOC 2015) Bank of China (BOC). 2015. “Comparison of China and US Bank Reserves and Their Implications.” Economic Review.

Report issued by the Bank of China, a state-owned bank, on the reserve regime in the United States as compared to China.

-

(IMF 2011) International Monetary Fund (IMF). 2011. “People’s Republic of China: Financial System Stability Assessment.” IMF Staff Country Reports 11, no. 321: 1.

IMF’s 2011 Financial Stability Assessment Report on China.

-

(PBOC 2006b) People’s Bank of China (PBOC). 2006b. “Monetary Policy Report 2006 Q2.”

The PBOC’s second Monetary Policy Report of 2006.

-

(PBOC 2007) People’s Bank of China (PBOC). 2007. “Monetary Policy Report 2007 Q3.”

The PBOC’s third Monetary Policy Report of 2007.

-

(PBOC 2008f) People’s Bank of China (PBOC). 2008f. “Monetary Policy Report 2008 Q1.”

The PBOC’s first Monetary Policy Report of 2008.

-

(PBOC 2008g) People’s Bank of China (PBOC). 2008g. “Monetary Policy Report 2008 Q2.”

The PBOC’s second Monetary Policy Report of 2008.

-

(PBOC 2008h) People’s Bank of China (PBOC). 2008h. “Monetary Policy Report 2008 Q3.”

The PBOC’s third Monetary Policy Report of 2008.

-

(PBOC 2008i) People’s Bank of China (PBOC). 2008i. “Monetary Policy Report 2008 Q4.”

The PBOC’s fourth Monetary Policy Report of 2008.

-

(PBOC 2009a) People’s Bank of China (PBOC). 2009a. “Financial Stability Report 2009.”

PBOC Financial Stability Report 2009.

-

(PBOC 2009b) People’s Bank of China (PBOC). 2009b. “International Financial Market Report,” March.

Report from the PBOC’s International Financial Market Analysis Group covering international market developments and the PBOC’s activities in 2008.

-

(PBOC 2010a) People’s Bank of China (PBOC). 2010a. “Annual Report 2009.”

PBOC Annual Report for 2009.

-

(PBOC 2010b) People’s Bank of China (PBOC). 2010b. “Monetary Policy Report 2010 Q1.”

The PBOC’s first Monetary Policy Report of 2010.

-

(PBOC 2010c) People’s Bank of China (PBOC). 2010c. “Monetary Policy Report 2010 Q2.”

The PBOC’s second Monetary Policy Report of 2008.

-

(PBOC 2010d) People’s Bank of China (PBOC). 2010d. “Monetary Policy Report 2010 Q4.”

The PBOC’s fourth Monetary Policy Report of 2008.

-

(PBOC 2011a) People’s Bank of China (PBOC). 2011a. “Annual Report 2010.”

PBOC Annual Report for 2010.

-

(PBOC 2011b) People’s Bank of China (PBOC). 2011b. “Financial Stability Report 2011.”

PBOC Financial Stability Report 2011.

-

(Chang, Liu, Spiegel, and Zhang 2017) Chang, Chun, Zheng Liu, Mark M Spiegel, and Jingyi Zhang. 2017. “Reserve Requirements and Optimal Chinese Stabilization Policy,” June, 40.

Analysis of SOEs (subject to reserve requirements) and private firms (using off-balance sheet financing).

-

(Cong et al. 2018) Cong, Lin William, Haoyu Gao, Jacopo Ponticelli, and Xiaoguang Yang. 2018. “Credit Allocation under Economic Stimulus: Evidence from China.” SSRN Scholarly Paper ID 2862101. Rochester, NY: Social Science Research Network.

Analysis of credit allocation in the aftermath of the GFC.

-

(Elliott and Yan 2013) Elliott, Douglas J., and Kai Yan. 2013. “The Chinese Financial System: An Introduction and Overview.” John L. Thornton China Center at Brookings, July.

Overview of the Chinese financial system.

-

(Fungáčová, Nuutilaine, and Weill 2015) Fungáčová, Zuzana, Riikka Nuutilaine, and Laurent Weill. 2015. “Reserve Requirements and the Bank Lending Channel in China.”

Academic paper analyzing China’s reserve requirements policy.

-

(Klingelhöfer and Sun n.d.) Klingelhöfer, Jan and Rongrong Sun (Klingelhöfer and Sun). n.d. “The Renaissance of Macroprudential Monetary Policy Tools: Evidence from China.”

Paper analyzing the use monetary policy tools for macroprudential purposes, including required reserves.

-

(Lardy 2008) Lardy, Nicholas R. 2008. “Financial Repression in China.” Peterson Institute for International Economics.

Analysis of China’s “financial repression,” or the low and negative real return on deposits.

-

(Li, Willett, and Zhang 2012) Li, Linyue, Thomas D. Willett, and Nan Zhang. 2012. “The Effects of the Global Financial Crisis on China’s Financial Market and Macroeconomy.” Economics Research International 2012, March: e961694.

Overview of the impact of, and China’s response to, the GFC.

-

(Martin 2012) Martin, Michael F. 2012. “China’s Banking System: Issues for Congress,” February, 51.

Congressional Research Service report on China’s banking system.

-

(Miao 2015) Miao, Meng. 2015. “The Cyclicality of Political Connections: An Investigation into Changes in Reserve Requirements in China.” SSRN Scholarly Paper 2609314. Rochester, NY: Social Science Research Network.

Analysis of the influence of political connections on the impact of changes to required reserves.

-

(Morrison 2009) Morrison, Wayne M. 2009. “China and the Global Financial Crisis: Implications for the United States,” June.

Congressional Research Service report on the effect of the GFC on China.

-

(Ouyang, Rajan, and Willett 2010) Ouyang, Alice Y., Ramkishen S. Rajan, and Thomas D. Willett. 2010. “China as a Reserve Sink: The Evidence from Offset and Sterilization Coefficients.” Journal of International Money and Finance 29, no. 5: 951–72.

Overview of China’s accumulation of FX reserves.

-

(Pan et al. 2012) Pan, Haiying, Huan Song, Yu Wang, and Yangyang Hu. 2012. “Analysis of the Effects of Frequent Increases of the Reserve Requirement Ratio by the People’s Bank of China” 2012, March.

Analysis of the PBOC’s RRR policy, focusing on the effects of the many, frequent changes to the ratio over the period analyzed in this case study.

-

(PBOC 2010e) People’s Bank of China (PBOC). 2010e. “Central Bank Instruments to Deal with the Crisis - from the Perspective of the People’s Bank of China.” BIS Papers No 54.

Paper presented at a conference at the Bank for International Settlements on 28–29 January 2010. All papers were on the topic “The global crisis and financial intermediation in emerging market economies.”

-

(Setser and Pandey n.d.) Setser, Brad, and Arpana Pandey. n.d. “China’s $1.7 Trillion Bet.”

CFR working paper on China’s US dollar holdings.

-

(Sun 2013) Sun, Rongrong. 2013. “Does Monetary Policy Matter in China? A Narrative Approach.”

Review of China’s monetary policy tools and their isolated effects on China’s economy.

-

(Turner, Tan, and Sadeghian 2012) Turner, Grant, Nicholas Tan, and Dena Sadeghian. 2012. “The Chinese Banking System.”

Reserve Bank of Australia staff report on the Chinese Banking System.

-

(Wang and Hu 2011) Wang, Tao, and Harrison Hu. 2011. “The China Monetary Policy Handbook,” February.

UBS analyst report on China’s monetary policy.

-

(Wong 2011) Wong, Christine. 2011. “The Fiscal Stimulus Programme and Public Governance Issues in China.” OECD Journal on Budgeting 11, no. 3: 1–22.

Overview of China’s fiscal stimulus response to the GFC.

-

(Wu 2007) Wu Xiaoling. 2007. “Excess Liquidity and Financial Market Risks.”

Speech by a Deputy Governor of the People’s Bank of China addressing liquidity surpluses in China’s financial system.

-

(Zhang n.d.) Zhang, Liqing. n.d. “China’s Policy Responses to the Global Financial Crisis: Efficacy and Risks.”

Overview of China’s fiscal and monetary policy response to the GFC.

Figure 8: Overview of the Chinese Financial System

Source: Elliott and Yan 2013.

Source: Elliott and Yan 2013.

Figure 9: Share of Total Assets by Bank Type

Source: Elliott and Yan 2013.

Source: Elliott and Yan 2013.

Figure 10: The PBOC’s Monetary Policy Tools

Source: Sun 2013.

Source: Sun 2013.

Figure 11: History of Reserve Requirements in China, 1984–2011

Source: Ma, Xiandong, and Xi 2013.

Source: Ma, Xiandong, and Xi 2013.

Taxonomy

Intervention Categories:

- Reserve Requirements

Countries and Regions:

- China

Crises:

- Global Financial Crisis