Reserve Requirements

Brazil: Reserve Requirements, GFC

Purpose

To counteract the significant decline in liquidity of the financial system and to induce deposits from large to smaller banks

Key Terms

-

Range of RR Ratio (RRR) Peak-to-Trough53.0%–42.0% (demand deposits); 30.0%–20.0% (savings deposits); 8.0%–9.0% (time deposits)

-

RRR Increase PeriodNot applicable

-

RRR Decrease PeriodSeptember–December 2008

-

Legal AuthorityArticle 10(3) of Law 4575

-

Interest/Remuneration on ReservesSelic (policy) rate, on two of the three categories of reserve assets

-

Notable FeaturesMost of the reserve impact was from increases in the deductions banks could take, rather than the headline RRR ratios; many inducements to move funds from large to smaller banks

-

OutcomesBRL 116 billion–BRL 145 billion (USD 71 billion–USD 88 billion) in reserves released

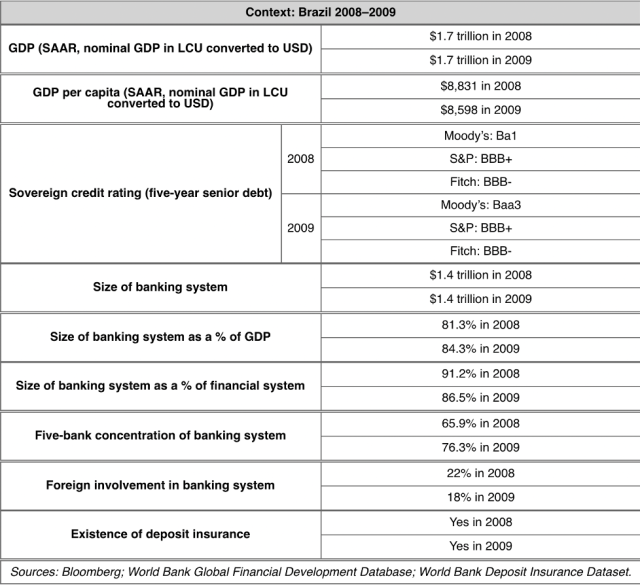

After the collapse of Lehman Brothers in September 2008, deposits began to accumulate at large Brazilian banks, representing a flight to safety away from small and medium-sized banks. While total deposits in the Brazilian financial system grew by 13% from August 2008 to January 2009, the total deposits held by small and medium-sized banks declined by 23% and 11%, respectively. Because of high statutory reserve requirements and legal disincentives to lend directly to financial institutions, the Central Bank of Brazil (BCB) used reserve requirements as its primary tool for providing liquidity to incentivize large banks to provide credit to smaller banks, starting in October 2008. In October 2008, the BCB lowered reserve requirements for all banks. It also increased eligibility thresholds, which released some smaller banks from holding required reserves, provided voluntary deductions for large banks that lent to smaller banks, and effectively mandated that large banks spread liquidity to smaller banks. The BCB maintained these policies throughout the crisis and did not begin raising reserve requirements until 2010. The BCB estimated that these actions released BRL 116 billion (USD 71 billion) of reserves into the system, or 4% of GDP. Most of the impact was from increases in the deductions that banks could take from their requirements, rather than from the headline cuts in reserve requirement ratios.

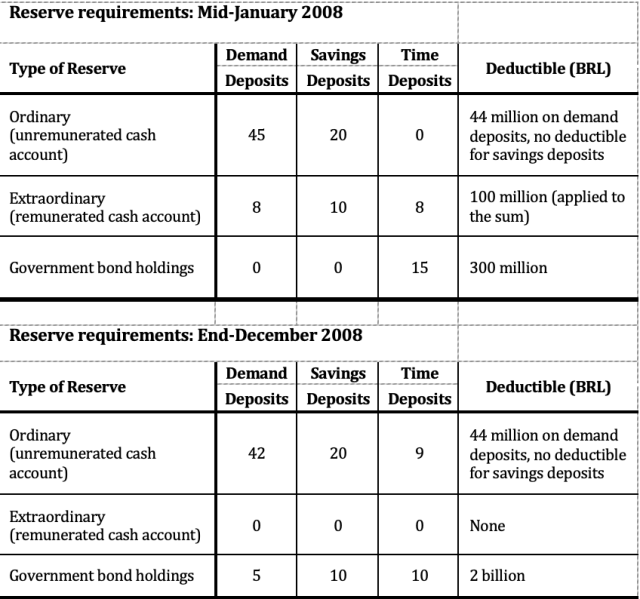

In the leadup to the Global Financial Crisis (GFC), Brazil stood out for setting high and complex reserve requirements, as a leftover of 1990s stabilization policy (OECD 2009). The Central Bank of Brazil (BCB) had three different types of requirements: ordinary requirements that paid low or no interest, extraordinary requirements that banks held in cash with the central bank at the target interest rate, and a government bond-holding requirement against time deposits.FMost of the reserves held for the ordinary reserve requirement backed demand deposits and paid no interest. Required reserves that backed savings deposits paid interest well below market rates (Robitaille 2011, 62). The statutory reserve requirements were quite high—the highest effective rate was 53%, applied to demand deposits, which included 45% in ordinary reserves and 8% in extraordinary cash reserves. However, the BCB operated a system of deductions that freed many small banks from holding any required reserves at all (Robitaille 2011).

When the GFC worsened after the collapse of Lehman Brothers in September 2008, deposits in the Brazilian financial system began to accumulate among the largest banks. Rather than a systemic leakage of deposits out of Brazil, this represented a “flight to safety” from small and medium-sized banks to large banks. From August 2008 to January 2009, total deposits grew 20% in large banks but fell 23% and 11% in small and medium-sized banks, respectively (Mesquita and Torós 2010).

In response to this movement, the Central Bank of Brazil (BCB) lowered many of its reserve requirements as its “main liquidity provision tool,” owing to the relatively high levels of required reserves and legal disincentives to provide direct loans (Robitaille 2011, 30). The BCB also increased the eligibility deductions to allow some banks to avoid holding required reserves. These actions took place between September and December 2008.

The BCB’s goal was to release reserves from large banks and build them at smaller banks. The BCB required large banks to purchase loan portfolios of small and medium-sized banks by forcing large banks to shift their reserves on time deposits from remunerated government bond holdings to unremunerated cash (BCB 2008g). The BCB also employed other strategies to release reserves from large banks, such as a deduction for prepaying contributions to the deposit insurance fund that purchased loan portfolios, a deduction for foreign-exchange swap purchases, and a deduction for (effectively) making loans to the government development bank, BNDES.

See Figure 1 for a depiction of effective reserve requirement ratios in the Brazilian banking system, with declines at the end of 2008, most notably on time deposits. In this instance, effective reserve requirement ratios represent the actual level of required reserves held by banks post-deductions. However, effective ratios still remained quite high compared to that of most countries. Figure 2 summarizes the three types of reserve requirements applied to the three types of deposits in 2008, along with the relevant deductible.

Figure 1: Effective Reserve Requirement Ratios (%)

Note: The reserve requirements for demand, savings, and time deposits in the figure include both ordinary requirements on demand and savings deposits and the government bond-holding requirement on all three types of deposits. The extraordinary requirement is an additional requirement that the BCB required banks to hold in cash (Robitaille 2011). For more details, see Key Design Decision No. 12, Changes in Reserve Requirements. The dotted line represents the failure of Lehman Brothers on September 15, 2008, after which the BCB began to adjust reserve requirements to promote liquidity.

Source: Cavalcanti and Vonbun 2013.

Figure 2: Overview of Reserve Requirements

Source: Robitaille 2011.

In a section on the BCB’s website explaining how it responded to the GFC, the BCB writes that:

the existence of comfortable levels of required reserves allowed the BCB to inject liquidity rapidly into the Brazilian banking system, contributing to a normalization of credit conditions in the economy. (BCB n.d.b, author’s translation)

Prior to the GFC, banks held more than 250 billion reais (USD 153 billion)FUSD 1 = BRL 1.64 on September 1, 2008, according to Yahoo Finance. in required reserves at the BCB. By August 2009, required reserves would have totaled 295 billion reais (BRL) under precrisis rules, according to BCB estimates. However, banks held only BRL 179 billion at that point, which implies that the measures taken by the BCB helped release BRL 116 billion in reserves, or 4% of GDP. In particular, the changes to the extraordinary cash reserve requirement released BRL 42 billion, and the adjustments to the reserve requirements applied to time deposits released BRL 62 billion (Mesquita and Torós 2010).

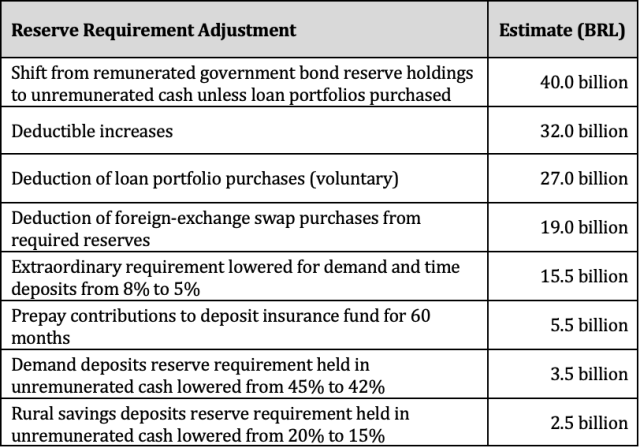

The Organisation for Economic Co-operation and Development (OECD) estimated the BCB’s measures released BRL 145 billion in liquidity, ultimately concluding that most of the reserves released into the system resulted from increases in the deductions that banks could take from their requirements, rather than from the headline cuts in reserve requirement ratios. The OECD calculated different breakdowns of liquidity released by the BCB. See Figure 3 for estimates relating to reserve requirement policy.

Figure 3: Estimated Liquidity Released by Reserve Requirement Adjustments

Source: OECD 2009.

Source: OECD 2009.

In calculating its estimates, the OECD noted that the BCB allowed banks to deduct purchases of foreign-exchange swaps from their required reserves—which the OECD estimated would release BRL 19 billion of reserves—accounting for part of the difference in estimates made by the OECD and Mesquita and Torós (OECD 2009).

According to the OECD in 2009, “the impact of the liquidity-boosting measures on longer-term credit creation is still unclear, but recent trends are encouraging” (OECD 2009, 26). One of the issues limiting the effectiveness of lowering reserve requirements was the increase in excess reserves placed at the BCB by banks. However, the OECD recommended that the BCB eliminate its high reserve requirements, as they tend to raise the costs of intermediation. The OECD noted that reserve requirement policies had served as “useful instruments to manage liquidity in periods of financial stress” (OECD 2009, 60).

Robitaille (2011, 36) states that, in general, the reserve requirement policy implemented by the BCB during the GFC “does not appear to have been as successful as has been asserted” at circulating liquidity from large banks to small and medium-sized banks. The author instead claims that

direct and indirect assistance from government-owned or government-supported entities played a more crucial role in alleviating funding pressures at that time. (Robitaille 2011)

Key Design Decisions

Purpose

1

In the aftermath of the failure of Lehman Brothers in September 2008, capital flows to emerging markets collapsed, causing funding pressure for Brazilian banks. During the week of October 6, 2008, between BRL 30 billion and BRL 40 billion in deposits moved from small and medium-sized banks to large banks that depositors viewed as safer (Romero and Ribeiro 2009). This represented 5.5% to 7.5% of total time deposits at the end of September (Robitaille 2011).

According to the BCB’s description of its actions during the GFC,

the adopted measures by the government and the Central Bank of Brazil to mitigate the effects of the domestic banking system crisis were aimed, principally, to counteract the significant decrease in liquidity of the financial markets (BCB n.d.b, author’s translation).

The BCB’s approach to liquidity provision followed three main principles during the GFC, according to a discussion paper that two BCB deputy governors published after the crisis: 1) keep inflation converging to the target rate, 2) minimize the exposure of the BCB to the private sector, and 3) avoid rewarding and encouraging moral hazard by private sector actors. The deputy governors say that the GFC did not result in deposits leaving Brazil in a systematic manner but rather led to a concentration of deposits among a few large institutions. From August 2008 to January 2009, total deposits grew by 20% for large banks while small and medium-sized banks’ deposits declined by 23% and 11%, respectively (Mesquita and Torós 2010).Through its reserve requirement policy changes, the BCB attempted to reverse this accumulation of deposits among the largest banks of Brazil.

FTotal overall deposits in the system grew by 13% during this period.

Part of a Package

1

Prior to the GFC, Brazilian banks began to draw on a type of funding that they called termed repo but which functioned effectively as time deposits. These transactions allowed banks to avoid time deposit reserve requirements. In early 2008, the BCB announced that it would set high reserve requirements for termed repos, effectively tightening reserve requirements. However, the BCB delayed the implementation of this policy during the GFC. The delay in effect loosened reserve requirements during the crisis (Robitaille 2011).

In an attempt to provide liquidity to smaller financial institutions, the Brazilian deposit insurance fund (FGC) purchased loan portfolios of smaller banks (OECD 2009). At the start of the crisis, the FGC had only two full-time employees and only BRL 2.5 billion in lending capacity. Therefore, the BCB allowed banks to prepay up to 60 months of their required contributions to the FGC and deduct that from their unremunerated cash reserves held on demand deposits. According to Robitaille (2011), the FGC received BRL 5.4 billion in prepayments, implying an equivalent release of BRL 5.4 billion in reserves.

To enhance liquidity in foreign-exchange markets, the BCB also allowed banks to deduct purchases of foreign-exchange swaps from their required reserves, which the OECD estimated would release BRL 19 billion of reserves (OECD 2009).

Although banks could also turn to the discount window, doing so posed a stigma problem. The BCB itself described approaching the discount window prior to 1996 as “tantamount to being almost insolvent for a financial institution” (BCB 1999, 78). Since 1996, the BCB made several changes to the discount window to destigmatize it, through easing terms and widening eligibility. The BCB also improved the discount window’s legal and operational frameworks during the GFC to make it a more appealing source of liquidity for banks. Nonetheless, the discount window was unused during the GFC (Mesquita and Torós 2010).

Legal Authority

1

Law 4595 of 1964, which established the framework of the Brazilian financial system, granted the BCB the ability to establish reserve requirements (Robitaille 2011). Law 7730 of 1989, amending Law 4595, allowed the BCB to vary reserve requirements based on geographic regions, “the priorities attributed to the investments,” and type of financial institution (Morris 1964, sec. 10). Law 7730 specifically permits the BCB to lower reserve requirements on funds that are reinvested in agricultural financing with favorable terms (Casa Civil 1964).

Law 7730 permits the BCB to apply up to a 100% reserve requirement on demand deposits and up to 60% on other financial instruments. The law also states that the BCB can decide for the reserves to be held in cash or government debt and allows the BCB to determine if the reserves are remunerated or not (Casa Civil 1964).

At the time the government passed these laws, the BCB used reserve requirements as its main method of providing liquidity to the financial system. BCB officials said political pressure and scrutiny from the National Congress and the public discouraged its use of traditional lender-of-last-resort policy. The BCB, at the time, was not a formally independent institution, and officials at the BCB were liable for their actions for up to five years upon leaving office. Robitaille (2011, 29) found multiple examples of central bank officials facing investigations and public criticism prior to the GFC, stating that “the threat of legal action continues to be taken seriously.”

In the wake of a banking crisis in the late 1990s, the Brazilian National Congress passed a Fiscal Responsibility Law in 2000 that imposed limits on the BCB’s ability to lend to the financial sector (Robitaille 2011). This legislation barred the BCB from using public money to “rescue” financial institutions, unless the National Congress passed “specific laws” authorizing it (Congresso Nacional 2000, art. 28). This legislation allowed the BCB to provide “discount window operations and loans with maturities with less than 360 days to financial institutions” (Congresso Nacional 2000, art. 28). However, despite this carve-out for the discount window, the BCB remained hesitant to use it. Therefore, changing reserve requirements became the main tool for liquidity provision during the GFC.

Administration

1

The BCB administered changes to the RRR.

Governance

1

According to Law 4595, the National Monetary Council (CMN) had the authority to set reserve requirements. The CMN had the following members at the time: the Minister of State for Finance; the Minister of State for Planning, Budget and Management; and the President of the BCB (Casa Civil 1964). The BCB is the Secretariat of the CMN and establishes its agenda, which gives the central bank significant influence over its decisions (Costa de Moura and Bandeira 2017).

According to the Romero and Ribeiro (2009) oral history of the crisis, on October 10, 2008, two senior BCB officials—the Deputy Governor for Monetary Policy and the head of banking operations—worked together to determine which reserve requirements to change and how those tweaks would benefit individual banks. Work at the BCB continued around the clock throughout the weekend, with the BCB announcing on Monday, October 13 that it would change reserve requirements to release BRL 100 billion in reserves (Romero and Ribeiro 2009). Research did not determine external oversight of reserve requirement policy.

No Brazilian agency had an explicit financial stability mandate, but the BCB acted on a de facto mandate to monitor financial stability. As the Secretariat of the CMN, the BCB “heavily influences the design and structure of macroprudential policy,” as well as designed many of the policy instruments (Costa de Moura and Bandeira 2017, 78). Specifically, staffers at the BCB stated that “the BCB and CMN are jointly responsible for the management of macroprudential instruments including . . . reserve requirement ratios” (Costa de Moura and Bandeira 2017, 78).

Communication

1

The BCB announced changes to the reserve requirements through public circulars.

The day before the BCB announced a reserve requirement change on October 13, 2008, the President of the BCB met with the heads of the major banks in Brazil to request that they continue to use the interbank market, especially for small and medium-sized banks (Romero and Ribeiro 2009).

Assets Qualifying as Reserves

1

The BCB’s reserve requirements had to be fulfilled by three categories of assets: unremunerated cash (ordinary reserves), remunerated cash (extraordinary reserves), and government bond holdings. Article 10(3) of Law 4595 gave the BCB the authority to require reserves to take the form of cash and government securities (Casa Civil 1964). The two categories of cash reserves were kept at the BCB in reserve accounts (Robitaille 2011).

According to Robitaille (2011, 18), there did not appear to be many limitations on what constituted “government bond holdings,” so long as they were marketable. This included fixed-rate, floating-rate, and consumer price index-chained government securities.

Reservable Liabilities

1

As noted in Key Design Decision No. 12, Changes in Reserve Requirements, the BCB applied different ratios to different deposit types, with relatively high rates applied to demand and savings deposits (45.0% and 20.0%, respectively). Partly for this reason, time deposits have been the most important source of domestic funding for Brazilian banks since the 1990s (Robitaille 2011).FThe BCB required banks to lend 27% of demand deposits to the agriculture sector and 65% of savings deposits to the housing sector (Robitaille 2011, 17).

Computation

1

The BCB based reserve requirements on the average levels of liabilities over a maintenance period; it did not implement a marginal reserve requirement during the crisis. The BCB maintenance period was one to two weeks and the BCB used a half-lagged to lagged accounting measure, both depending on the type of deposit. In a lagged system, the maintenance period does not overlap with the calculation period, while the two periods overlap under a half-lagged system. The lagged system allows banks to know for certain the level of required reserves ahead of time but delays the implementation of changes to reserve requirements by a week or two (Montoro and Moreno 2011; Robitaille 2011).

Eligible Institutions

1

Although the BCB set high statutory reserve ratios prior to the GFC, deductions allowed small and medium-size banks to maintain much lower effective reserve ratios.

For the ordinary reserve requirement on demand deposits, banks could deduct BRL 44 million from their reserve requirement prior to the GFC. In effect, banks with less than BRL 98 million in demand deposits did not have to hold required reserves. The BCB did not change this deductible during the GFC (Robitaille 2011).

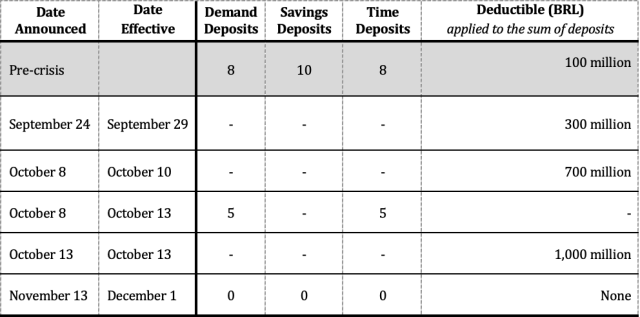

For the extraordinary reserve requirement, banks could deduct BRL 100 million from the sum of reserves held on time, demand, and savings deposits prior to the GFC (Robitaille 2011). In effect, banks were exempt from the extraordinary reserve requirement if their ordinary reserves on time, demand, and savings deposits were less than BRL 100 million. The BCB raised this deductible to BRL 300 million on September 24 (BCB 2008a), BRL 700 million on October 8 (BCB 2008c), and BRL 1 billion on October 13 (BCB 2008d). See Figure 7 for an overview of these changes.

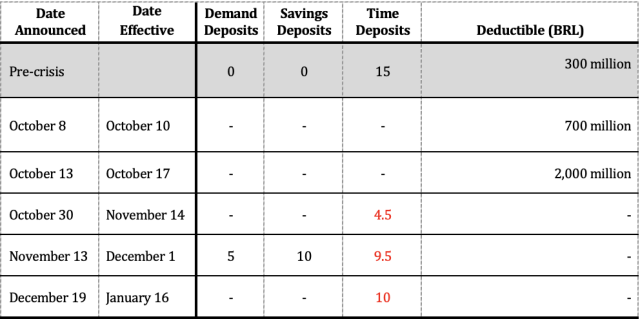

For the government bonds held in reserve against time deposits, banks could deduct BRL 300 million prior to the GFC. The BCB raised this deductible to BRL 700 million on October 8 (BCB 2008c) and BRL 2 billion on October 13 (BCB 2008d). See Figure 8 for an overview of these changes.

According to Robitaille (2011), only 41 out of 101 Brazilian banks held required reserves in December 2007. The remaining banks were smaller than the eligibility thresholds established by the deductibles.

Timing

1

The BCB adhered to a “separation principle,” in which it used separate tools to implement monetary policy and liquidity provision (Mesquita and Torós 2010). As can be seen in Figure 4, the BCB raised the Selic rate, the target policy rate, in the leadup to the collapse of Lehman Brothers in September 2008. However, after Lehman failed, the BCB eased reserve requirements to provide liquidity to the financial system. The BCB held the Selic rate constant during that period and only lowered it in 2009 after it stopped adjusting reserve requirements.

Figure 4: Selic Rate (%, daily)

Note: Dotted line represents the collapse of Lehman Brothers on September 15, 2008.

Source: BCB n.d.a.

Changes in Reserve Requirements

1

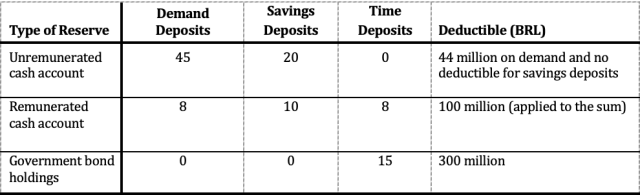

The BCB had three types of reserve requirements: ordinary requirements that paid low or no interest, extraordinary requirements that banks held in cash with the central bank at the target interest rate, and a government bond-holding requirement against time deposits (Robitaille 2011). Each of these categories will be discussed individually. See Figure 5 for an overview of the reserve requirements prior to the GFC.

Figure 5: Reserve Requirements in Mid-January 2008 (%)

Source: Robitaille 2011.

Source: Robitaille 2011.

Ordinary Reserve Requirement

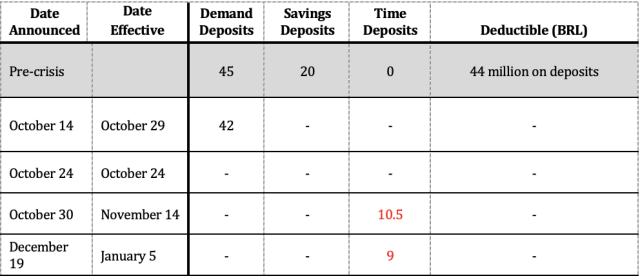

The BCB maintained high reserve ratios that had to be kept as unremunerated reserves. Pre-crisis, eligible institutions had to hold ordinary reserves to cover 45% of their demand deposits and 20% of their savings deposits (Robitaille 2011). On October 14, 2008, the BCB lowered the rate on demand deposits to 42% (BCB 2008f). This released about BRL 3.5 billion in reserves (OECD 2009). The BCB did not change this ratio for the remainder of the crisis period. The BCB never made a change to the reserve requirement for savings deposits during the crisis period.FHowever, the BCB did decrease the requirement for savings deposits of rural banks to 15% on October 30 (Cavalcanti and Vonbun 2013). The OECD estimated that this released BRL 2.5 billion (OECD 2009).

The BCB also introduced a quasi-statutory reserve requirement on time deposits, which is discussed in Key Design Decision No. 14, Other Restrictions. In effect, the BCB forced eligible institutions to move their time deposit reserves from government bonds to unremunerated reserves unless they provided liquidity to smaller banks in the financial system (Robitaille 2011). See Figure 6 for an overview of the changes applied to the unremunerated reserve requirement set by the BCB.

Figure 6: Reserve Requirement Changes to Unremunerated Reserves in 2008

Note: Red text indicates quasi-statutory ratios due to the other conditions applied by the BCB. A hyphen represents no change from the previous circular.

Note: Red text indicates quasi-statutory ratios due to the other conditions applied by the BCB. A hyphen represents no change from the previous circular.

Source: Robitaille 2011.

Extraordinary Reserve Requirement

Prior to the GFC, the BCB also had an extraordinary reserve requirement. It required eligible institutions to hold cash reserves with the central bank to cover 8% of demand deposits, 10% of savings deposits, and 8% of time deposits. On October 8, 2008, the BCB lowered the requirements for both demand and time deposits to 5% (BCB 2008c). This released an estimated BRL 15.5 billion in reserves (OECD 2009). Also, on November 13, the BCB required banks to hold their reserves for the extraordinary requirement against all three types of deposits in government bonds rather than cash with the central bank (BCB 2008h). According to Robitaille (2011), banks preferred to hold government bonds rather than cash because the BCB allowed them the intra-day discretion to deviate from the requirement in order to manage liquidity. See Figure 7 for an overview of the changes applied to the extraordinary cash requirement, as well as Figure 1 for a graphical representation.

Figure 7: Reserve Requirement Changes to the Extraordinary Cash Requirement in 2008

Note: A hyphen represents no change from the previous circular.

Note: A hyphen represents no change from the previous circular.

Source: Robitaille 2011.

Government Bond Holding Requirement

Prior to the crisis, the BCB required eligible institutions to hold government bonds backing 15% of their time deposits (Robitaille 2011). On October 30, 2008, this effectively dropped to 4.5% when the BCB forced banks to shift their reserves from remunerated government bonds to unremunerated cash reserves (BCB 2008g). This increased to a quasi-statutory ratio of 6% on December 19, 2008, as the BCB allowed banks to keep a greater amount of time deposit reserves in government bond holdings (BCB 2008i). The details of this action are discussed in more detail in Key Design Decision No. 14, Other Restrictions. As mentioned previously, the BCB shifted the cash holding component of the extraordinary requirement to government bond holdings on November 13, 2008. See Figure 8 for an overview of the changes applied to the government bond holding requirement.

Figure 8: Reserve Requirement Changes to Government Bond Holding Requirement in 2008

Note: Red text indicates quasi-statutory ratios due to the other conditions applied by the BCB. A hyphen represents no change from the previous circular.

Note: Red text indicates quasi-statutory ratios due to the other conditions applied by the BCB. A hyphen represents no change from the previous circular.

Source: Robitaille 2011.

According to Montoro and Moreno (2011), Brazil did not apply any reserve requirements to non-BRL assets.

Changes in Interest/Remuneration

1

Ordinary reserves paid low or no interest. Extraordinary cash reserves and government bond holdings earned the Selic rate, the BCB’s target policy rate.

Most ordinary cash that banks held as required reserves backed demand deposits and paid no interest. Required reserves that backed savings deposits did pay interest, albeit at a rate much lower than the Selic rate, considered well below market rates (Robitaille 2011).

The BCB also considered reducing the rate of remuneration on extraordinary cash reserves but ultimately did not do so, according to a newspaper article on October 20, 2008. President Lula criticized banks that placed surplus funds overnight with the BCB to receive interest rather than circulating the funds to other banks in the financial system. As noted in Key Design Decision No. 14, Other Restrictions, the BCB created a voluntary deduction to encourage banks to leave their surplus funds with other banks (D’Amorim 2008).

Other Restrictions

1

The BCB attempted to alleviate funding pressures on small and medium-sized banks by extending reserve requirement deductions. On October 2, 2008, the BCB allowed banks to deduct up to 40% of their government bond holding requirement against time deposits through the purchase of loan portfolios from small and medium-sized banks, institutions with less than BRL 2.5 billion in Tier 1 capital (88 out of 103 banks) (BCB 2008b). On October 13, the BCB increased this deduction to 70% and expanded eligibility to banks with less than BRL 7 billion in Tier 1 capital (97 out of 103 banks) (BCB 2008e). This policy effectively incentivized the largest six banks to deduct loan portfolio purchases from the remaining 97 banks. With this deduction, the BCB attempted to voluntarily shift reserves from large banks to smaller banks. The OECD estimated this released BRL 27 billion in reserves (OECD 2009).

However, the speed of loan portfolio purchases seemingly did not satisfy the BCB or President Lula (Robitaille 2011). The BCB announced on October 30, 2008, that banks had to shift 70% of their government bond holding requirement, which was remunerated, to unremunerated cash reserves unless they extended credit to smaller banks. This announcement in effect removed the voluntary aspect of the scheme through a negative cost incentive (BCB 2008g). As a result, it created a quasi-statutory reserve requirement for time deposits on unremunerated reserves at 10.5%, that is, 70% of the 15% government-bond holding requirement on time deposits, for banks that did not extend credit to smaller banks; they could hold the remaining 4.5% in government bonds (Robitaille 2011). There had previously not been a reserve requirement applied to time reserves that had to be held in unremunerated reserves (Robitaille 2011). The BCB decreased this shift to 60% on December 19, lowering the quasi-statutory ratio to 9% (BCB 2008i).

The BCB allowed the large banks to place funds with smaller banks in unsecured overnight interbank deposits, known as CDIs, to count as loan portfolio purchases. This freed up the purchasing banks from inspecting and assessing complicated loan portfolios. Additionally, the Circular regarding CDIs did not establish a minimum term, allowing large banks to continuously roll over the CDIs. Therefore, this essentially served as a loan (Robitaille 2011).

The BCB created another deduction on November 25 that banks could use to lessen the unremunerated reserve requirements on time deposits. Large banks could deduct purchased CDIs from BNDES from their reserve requirements, the government development bank, in effect lending to the government. The BNDES then channeled these funds to the non-financial sector. BNDES could issue up to BRL 6 billion of CDIs with maturities from 6 to 18 months. Within a year, the interbank liabilities of BNDES increased from 0 to BRL 5.4 billion (Robitaille 2011).

Impact on Monetary Policy Transmission

1

The BCB followed the “separation principle,” in which it used separate tools for monetary policy and liquidity provision.

Duration

1

The BCB did not preannounce end dates for the reserve requirement changes it made during the GFC. The changes were not permanent, as the BCB later raised reserve requirements and deductions after the GFC.

Key Program Documents

-

(BCB n.d.a) Banco Central do Brasil (BCB). n.d.a. “Selic Rate.”

Dataset containing the path of the Selic rate.

-

(BCB 2008a) Banco Central do Brasil (BCB). 2008a. “Circular 3,405, from the Banco Central do Brasil—BCB, Dated September 24, 2008.” Circular.

BCB Circular regarding Global Financial Crisis-era financial stability program (in Portuguese).

-

(Casa Civil 1964) Casa Civil. 1964. Lei No. 4595, de 31 de Dezembro de 1964.

Chapter II of Law No 4595 describing the National Monetary Council and the central bank’s responsibilities (in Portuguese).

-

(Congresso Nacional 2000) Congresso Nacional. 2000. The Brazilian Fiscal Responsibility Law (Translated).

Full text of the Brazilian Fiscal Responsibility Law, translated to English.

-

(Morris 1964) Morris, John Stephen. 1964. Law No. 4,595, Dated December 31, 1964. 27.

Law No 4595 describing the National Monetary Council and the central bank’s responsibilities.

-

(BCB 2008d) Banco Central do Brasil (BCB). 2008d. “Circular No. 3410.”

Circular from the central bank announcing that the deductible on the government bond holding requirement increased to BRL 2 billion and the deductible on the extraordinary requirement increased to BRL 1 billion (in Portuguese).

-

(D’Amorim 2008) D’Amorim, Sheila. 2008. “Governo Ameaça Reduzir Remuneração a Bancos - 20/10/2008,” October 20, 2008.

News article on the central bank’s decision to reduce reserves remuneration.

-

(Romero and Ribeiro 2009) Romero, Cristiano, and Alex Ribeiro. 2009. “Os bastidores da crise.” Valor Econômico, November 13, 2009.

Newspaper account behind the scenes of the BCB’s response to the GFC.

-

(BCB 2008b) Banco Central do Brasil (BCB). 2008b. “Circular No. 3407.”

Circular from the central bank announcing that banks could deduct 40% of the 15% reserve requirement on government bond holdings for loan portfolios of small banks (in Portuguese).

-

(BCB 2008c) Banco Central do Brasil (BCB). 2008c. “Circular No. 3408.”

Circular from the central bank announcing an increase in the deductible on the extraordinary requirement to BRL 700 million and a reduction of the extraordinary requirements on demand and time deposits to 5% each (in Portuguese).

-

(BCB 2008d) Banco Central do Brasil (BCB). 2008d. “Circular No. 3410.”

Circular from the central bank announcing an increase in the deductible on the extraordinary requirement to BRL 700 million and a reduction of the extraordinary requirements on demand and time deposits to 5% each (in Portuguese).

-

(BCB 2008e) Banco Central do Brasil (BCB). 2008e. “Circular No. 3411.”

Circular from the central bank announcing an increase in the amount of government bond holdings that banks could exchange for loan portfolios to 70% (in Portuguese).

-

(BCB 2008f) Banco Central do Brasil (BCB). 2008f. “Circular No. 3413.”

Circular from the central bank announcing a reduction in the demand deposit ratio for non-interest-bearing reserves to 42% (in Portuguese).

-

(BCB 2008g) Banco Central do Brasil (BCB). 2008g. “Circular No. 3417.”

Circular from the central bank that required banks to move 70% of their government bond holding required reserves to non-interest-bearing reserves, unless they extended credit to certain smaller banks (in Portuguese).

-

(BCB 2008h) Banco Central do Brasil (BCB). 2008h. “Circular No. 3419.”

Circular from the central bank announcing that banks had to hold their reserves for the extraordinary requirement against all three types of deposits in government bonds rather than cash with the central bank (in Portuguese).

-

(BCB 2008i) Banco Central do Brasil (BCB). 2008i. “Circular No. 3427.”

Circular from the central bank announcing a reserve requirement change to time reserves (in Portuguese).

-

(BCB n.d.b) Banco Central do Brasil (BCB). n.d.b. “Perguntas frequentes - Recolhimentos Compulsórios.” Accessed March 4, 2022.

FAQ circulated by the Brazilian central bank (in Portuguese).

-

(BCB 1999) Banco Central do Brasil (BCB). 1999. “Monetary Policy Operating Procedures in Brazil.” Bank for International Settlements.

Central bank document outlining monetary policy procedures in Brazil in 1999.

-

(Cavalcanti and Vonbun 2013) Cavalcanti, Marco, and Christian Vonbun. 2013. “Recolhimento Compulsório no Brasil Pós-Real.” Instituto de Pesquisa Econômica Aplicada.

IPEA report on the BCB’s handling of reserve requirements, including changes according to different deposit types (in Portuguese).

-

(OECD 2009) Organisation for Economic Co-Operation and Development (OECD). 2009. “OECD Economic Surveys: Brazil 2009.” 14.

OECD Economic Survey summarising and analysing Brazil’s policy response to the Global Financial Crisis in 2009.

-

(Costa de Moura and Bandeira 2017) Costa de Moura, Maurício, and Fernanda Martins Bandeira. 2017. “Macroprudential Policy in Brazil.” BIS Paper No. 94f. Bank for International Settlements.

BIS note discussing Brazil’s financial stability policy framework in terms of institutional arrangements, the experience with macroprudential instruments, and ongoing initiatives to enhance the framework.

-

(Mesquita and Torós 2010) Mesquita, Mário, and Mario Torós. 2010. “Considerações Sobre a Atuação Do Banco Central Na Crise de 2008.” 202. Working Papers Series. Working Papers Series. Central Bank of Brazil, Research Department.

Working paper by two BCB Deputy Governors analysing the central bank’s actions during the crisis of 2008 (in Portuguese).

-

(Montoro and Moreno 2011) Montoro, Carlos, and Ramon Moreno. 2011. “The Use of Reserve Requirements as a Policy Instrument in Latin America.” Bank for International Settlements, BIS Quarterly Review.

Paper exploring the use of reserve requirements in three inflation targeting Latin American countries (Brazil, Colombia, and Peru) in recent years.

-

(Robitaille 2011) Robitaille, Patrice. 2011. “Liquidity and Reserve Requirements in Brazil.” International Finance Discussion Paper. Washington DC: Board of Governors of the Federal Reserve System.

Federal Reserve discussion paper regarding the Brazilian experience prior to and during the Global Financial Crisis as a case study that can shed light on the challenges of using reserve requirements as a liquidity management tool.

Taxonomy

Intervention Categories:

- Reserve Requirements

Countries and Regions:

- Brazil

Crises:

- Global Financial Crisis